Forex trading can be exhilarating, but let’s face it, it’s also fraught with risk. The market moves fast, and unexpected events can send your carefully planned trades spiraling downwards. Wouldn’t it be great to have a safety net? That’s where hedging comes in. Hedging in forex is like insurance for your trades, a way to protect your capital from adverse price movements. This article will break down the concept of forex hedging, explore different strategies, and help you determine if it’s the right approach for your trading style.

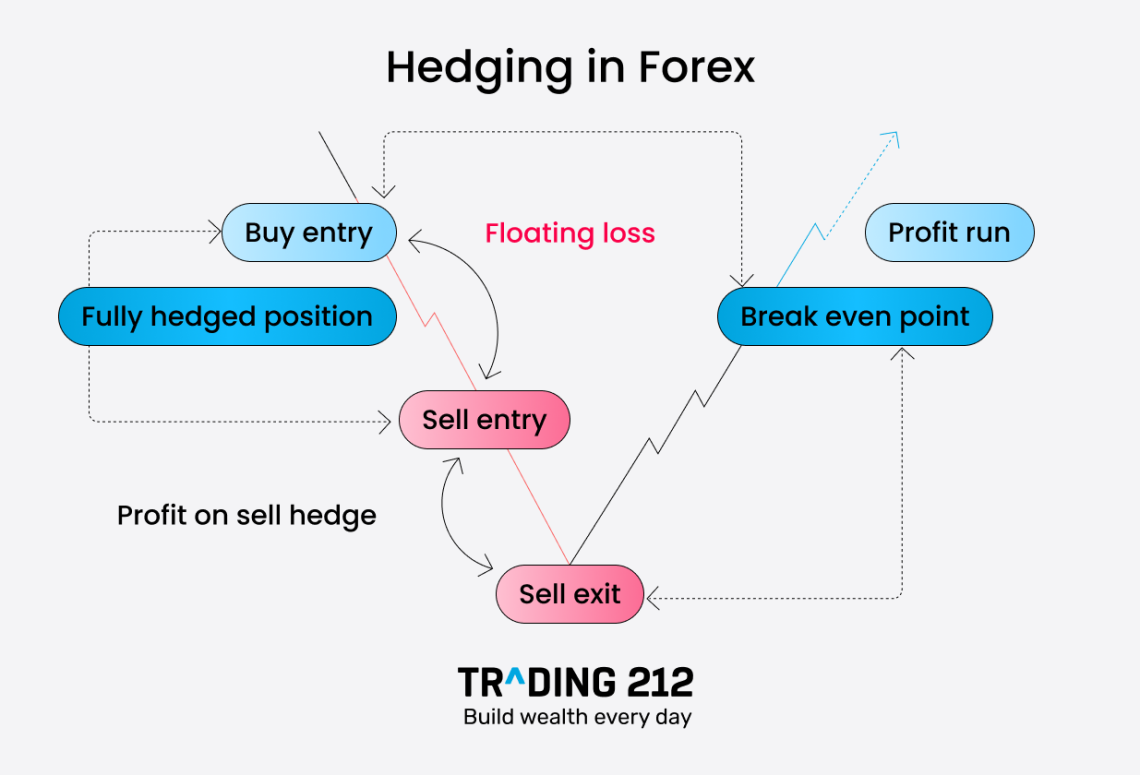

So, what exactly is hedging in forex trading? Simply put, it’s a strategy used to reduce the risk of losses on your existing or anticipated trades. Think of it as taking an offsetting position to protect yourself from potential negative price fluctuations. You’re essentially trying to neutralize the impact of unfavorable market movements on your portfolio. It’s not about guaranteeing profits, but rather about limiting potential downsides.

Why Use Forex Hedging Strategies?

Why bother with hedging at all? Well, there are several compelling reasons. First and foremost, it’s about risk management. Hedging can help you sleep better at night knowing that your capital is somewhat protected. It also allows you to stay in the market during periods of uncertainty without having to close out your positions entirely. Consider these benefits:

- Risk Reduction: Minimizes potential losses from adverse price movements.

- Capital Preservation: Protects your trading capital.

- Flexibility: Allows you to maintain positions during volatile periods.

- Opportunity to Re-evaluate: Gives you time to analyze the market without the pressure of immediate losses.

Ultimately, hedging provides a safety net, allowing you to trade with greater confidence and potentially improve your long-term profitability.

Common Forex Hedging Techniques

There are several ways to implement hedging strategies in forex trading. Let’s look at some of the most popular techniques:

Direct Forex Hedging: The Classic Approach

This involves opening opposing positions in the same currency pair. For example, if you’re long EUR/USD, you would open a short position in EUR/USD. This effectively locks in your current profit or loss, regardless of future price movements. It’s like hitting the pause button on that particular trade.

Correlation Hedging: Trading Related Pairs

This strategy involves trading currency pairs that have a strong positive or negative correlation. For example, if you’re long AUD/USD and you believe the Australian dollar is about to weaken, you might short NZD/USD (which is positively correlated with AUD/USD) to hedge your position. The idea is that if AUD/USD falls, NZD/USD will likely fall as well, offsetting some of your losses.

Multi-Currency Hedging: Diversifying Your Protection

This involves using multiple currency pairs to hedge your overall portfolio risk. This is a more complex strategy that requires a deep understanding of currency correlations and market dynamics. It’s like spreading your insurance across multiple policies;

Tip: Always backtest your hedging strategies on a demo account before implementing them with real money. This will help you understand how they work and identify potential weaknesses.

Using Options for Forex Hedging

Options contracts offer another powerful way to hedge your forex positions. Buying put options can protect you from downside risk, while buying call options can protect you from upside risk. Options provide flexibility and can be tailored to your specific risk tolerance and trading objectives.

Is Forex Hedging Right for You?

Hedging isn’t for everyone. It requires a good understanding of market dynamics and a disciplined approach. It’s not a “get rich quick” scheme, but rather a tool for managing risk. Consider these factors before implementing hedging strategies:

- Your Risk Tolerance: Are you comfortable with taking on additional complexity to reduce risk?

- Your Trading Style: Do you prefer short-term or long-term trading?

- Your Capital: Do you have enough capital to effectively implement hedging strategies?

- Your Knowledge: Do you have a solid understanding of currency correlations and market dynamics?

If you’re a beginner trader, it’s best to start with simpler risk management techniques before diving into hedging. However, if you’re an experienced trader looking to protect your capital and improve your long-term profitability, hedging may be a valuable tool to add to your arsenal.

Important Note: Hedging can reduce potential profits as well as losses. It’s a trade-off between risk and reward.

Forex Hedging: Potential Drawbacks to Consider

While hedging offers significant benefits, it’s crucial to be aware of its potential drawbacks. One major concern is the increased complexity involved. Managing multiple positions and understanding currency correlations can be challenging, especially for novice traders. Additionally, hedging can incur additional costs, such as transaction fees and spread costs. These costs can eat into your profits if not managed carefully. Finally, over-hedging can lead to analysis paralysis and missed opportunities. It’s important to strike a balance between protecting your capital and allowing your trades to generate profits.

FAQ: Frequently Asked Questions About Forex Hedging

What is the main goal of hedging in forex trading?

The primary goal is to reduce the risk of losses on your existing or anticipated trades by taking offsetting positions.

Is hedging a guaranteed way to make profits?

No, hedging is not a guaranteed profit strategy. It’s a risk management tool designed to limit potential losses.

Is forex hedging suitable for all traders?

No, hedging is not suitable for all traders. It requires a good understanding of market dynamics and a disciplined approach. Beginners should focus on simpler risk management techniques first.

What are some common forex hedging techniques?

Common techniques include direct hedging, correlation hedging, multi-currency hedging, and using options contracts.

What are the potential drawbacks of forex hedging?

Potential drawbacks include increased complexity, additional costs, and the potential for reduced profits.

So, there you have it – a comprehensive look at hedging in forex trading. It’s a powerful tool that can help you protect your capital and navigate the volatile forex market with greater confidence. But remember, it’s not a magic bullet. It requires careful planning, disciplined execution, and a thorough understanding of market dynamics. Take the time to learn the ropes, practice on a demo account, and determine if hedging is the right fit for your trading style. With the right approach, hedging can be a valuable asset in your forex trading journey. Good luck, and happy trading!