So, you’re looking to dive into the world of trading in South Africa? That’s fantastic! But timing is everything, isn’t it? Just like catching the perfect wave or enjoying a sundowner at the right moment, knowing the best time to trade can significantly impact your success. It’s not a one-size-fits-all answer, though. The optimal trading time depends heavily on your individual preferences, trading style, and the specific markets you’re interested in. Let’s break it down and find the perfect trading window for you.

Understanding the Importance of Timing for Trading in South Africa

Why is timing so crucial? Well, market volatility and liquidity fluctuate throughout the day. Think of it like this: during peak hours, there are more buyers and sellers, leading to tighter spreads and potentially more profitable trades. Conversely, during quieter periods, spreads can widen, and price movements might be less predictable. It’s about finding that sweet spot where opportunity meets stability.

How Global Markets Influence the Best Time to Trade

South Africa’s market is interconnected with global markets. The opening and closing times of major international exchanges significantly influence trading activity in South Africa. For example, the London Stock Exchange (LSE) and the New York Stock Exchange (NYSE) can have a ripple effect on the Johannesburg Stock Exchange (JSE).

Tip: Keep an eye on the economic calendars of major economies like the US, UK, and Europe. News releases and announcements can trigger significant market movements.

Best Time To Trade Forex in South Africa: Consider Currency Pairs

Forex trading is a 24-hour market, but that doesn’t mean every hour is created equal. The best time to trade Forex depends on the specific currency pairs you’re trading. Overlapping trading sessions often present the most lucrative opportunities.

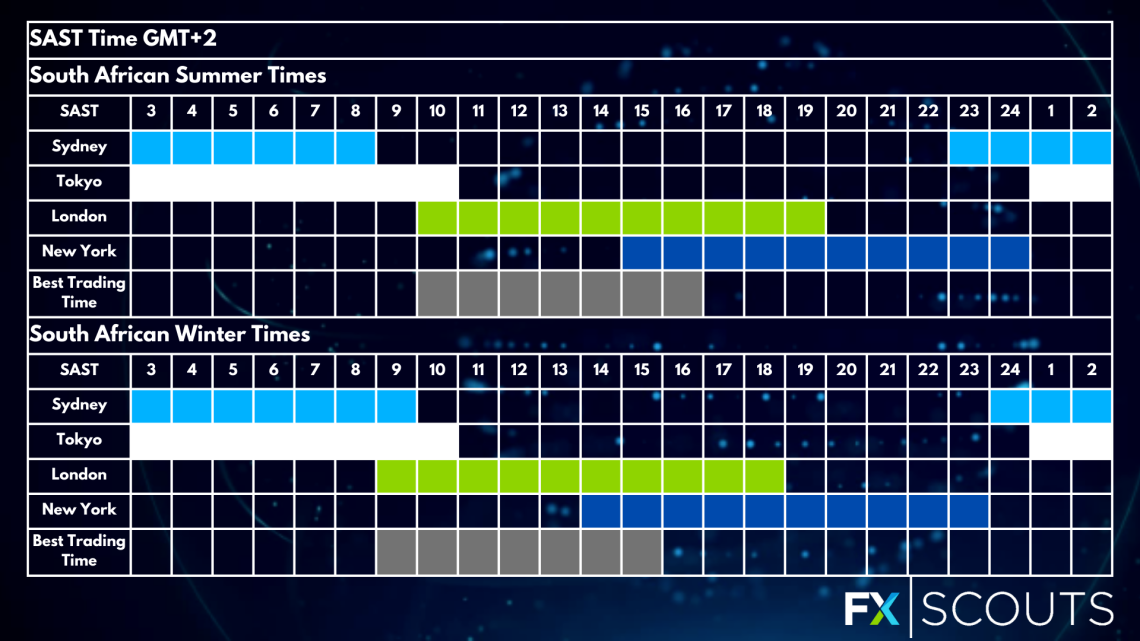

Overlapping Sessions for Forex Trading: Maximize Your Profits

When two major trading sessions overlap, you typically see increased volatility and liquidity. Here’s a breakdown:

- London and New York Overlap (3 PM ー 5 PM SAST): This is often considered the most active period for Forex trading, as it combines the European and North American trading volumes.

- Sydney and Tokyo Overlap (2 AM ー 9 AM SAST): While less volatile than the London/New York overlap, this can be a good time to trade Asian currency pairs.

Best Time To Trade Stocks in South Africa: JSE Focus

For those interested in trading South African stocks, the Johannesburg Stock Exchange (JSE) is your playground. The JSE’s trading hours are crucial to consider.

JSE Trading Hours: When the Action Happens

The JSE’s official trading hours are from 9:00 AM to 5:00 PM SAST. However, the most active trading usually occurs during the first few hours after the market opens and the last hour before it closes. Why? Because that’s when institutional investors and large traders are most active.

Interesting Fact: Many traders find the “opening bell” and “closing bell” periods to be the most volatile, offering both opportunities and risks.

Factors Affecting Stock Trading Times: News and Announcements

Keep in mind that company-specific news and economic announcements can significantly impact stock prices outside of regular trading hours. Stay informed about upcoming earnings reports, dividend announcements, and other market-moving events.

Best Time To Trade Commodities in South Africa: Gold, Platinum, and More

South Africa is a major producer of commodities like gold and platinum. Trading these commodities requires understanding their specific market dynamics.

Gold and Platinum Trading: Global Influences

The prices of gold and platinum are heavily influenced by global factors, including:

- US Dollar Strength: A stronger dollar often puts downward pressure on commodity prices.

- Geopolitical Events: Uncertainty and instability can drive investors towards safe-haven assets like gold.

- Supply and Demand: Production levels and industrial demand play a significant role in price fluctuations.

Consider Global Commodity Exchanges: Timing is Key

Pay attention to the trading hours of major commodity exchanges like the COMEX (for gold and silver) and the NYMEX (for platinum and palladium). Their opening and closing times can influence trading activity on the JSE.

Finding Your Personal Best Time To Trade: Tailoring to Your Style

Ultimately, the best time to trade is when you’re most alert, focused, and able to make rational decisions. Consider your personal schedule, risk tolerance, and trading strategy. Are you a scalper who thrives on quick profits, or a long-term investor who prefers a more patient approach? Your trading style will dictate the best times for you.

Questions to Ask Yourself: A Personalized Approach

Ask yourself these questions to find your ideal trading time:

- What are my peak performance hours?

- What is my risk tolerance?

- What markets am I most interested in?

- How much time can I realistically dedicate to trading each day?

FAQ: Frequently Asked Questions About Trading Times in South Africa

What is SAST?

SAST stands for South African Standard Time, which is GMT+2.

Does daylight saving time affect trading hours in South Africa?

No, South Africa does not observe daylight saving time, so trading hours remain consistent throughout the year.

Where can I find reliable market data?

Reputable financial news websites, trading platforms, and data providers offer real-time market data.

Is it better to trade in the morning or afternoon in South Africa?

It depends on the market you’re trading. For JSE stocks, the morning and late afternoon are often the most active. For Forex, the London/New York overlap (3 PM ─ 5 PM SAST) is usually a good time.

So, there you have it! Finding the best time to trade in South Africa is a journey of discovery. It’s about understanding market dynamics, considering your personal preferences, and staying informed. Don’t be afraid to experiment and adjust your trading schedule as needed. Remember, consistency and discipline are key to long-term success. Happy trading, and may the odds be ever in your favor! Now go out there and conquer the markets!