Understanding Forex Market Opening Hours: A Global Perspective

The Forex market, unlike stock exchanges, operates 24 hours a day, five days a week. This continuous operation is possible because it’s a decentralized global marketplace. However, understanding the different market sessions and their respective hora de apertura del mercado forex is crucial for successful trading. Different sessions exhibit varying levels of volatility and liquidity, impacting trading strategies.

The Major Forex Trading Sessions

The Forex market is broadly divided into four major trading sessions, each centered around a specific geographical region:

- Sydney Session: Often the quietest, marking the start of the trading week.

- Tokyo Session: Asian markets become active, influencing currency pairs involving the Japanese Yen.

- London Session: Characterized by high liquidity and volatility, often setting the trend for the day.

- New York Session: Overlaps with the London session, creating peak liquidity and volatility.

Understanding the characteristics of each session is vital for timing your trades effectively.

Tip: Pay close attention to the overlap between the London and New York sessions. This period typically offers the highest trading volume and the most significant price movements;

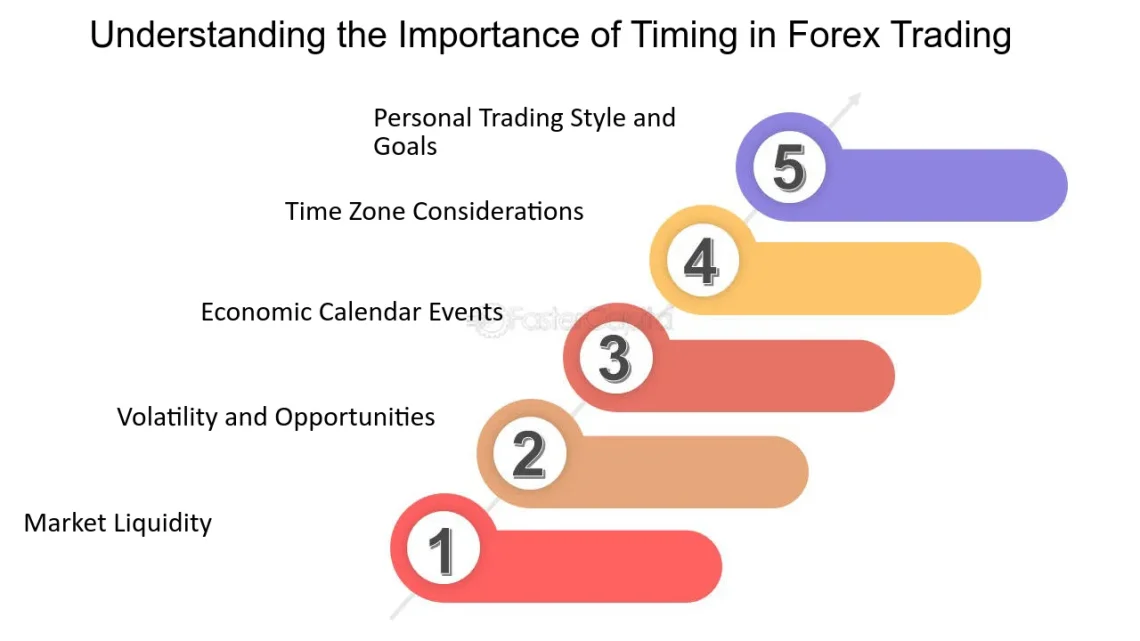

Why Knowing Forex Market Opening Hours Matters

Knowing the hora de apertura del mercado forex is not just about knowing when you can trade, but knowing when you should trade. Here’s why it’s important:

- Volatility: Different sessions have different volatility levels.

- Liquidity: Liquidity impacts the ease of entering and exiting trades.

- Trading Strategy: Your trading strategy should align with the market conditions of the session you’re trading.

For example, a scalper might prefer the high volatility of the London session, while a long-term investor might focus on the overall trend regardless of the specific session.

Optimizing Your Trading Strategy Based on Market Hours

Your trading strategy should be tailored to the specific market session. Consider these factors:

Volatility and Risk Management

Higher volatility requires tighter stop-loss orders and smaller position sizes. Lower volatility might allow for wider stop-loss orders and larger positions.

Currency Pair Selection

Focus on currency pairs that are most active during the session. For example, JPY pairs are typically more active during the Tokyo session.

News Events

Be aware of economic news releases scheduled for each session, as these can significantly impact currency prices.

FAQ: Frequently Asked Questions About Forex Market Hours

Advanced Strategies for Leveraging Forex Market Hours

Beyond the fundamental understanding of session timings, sophisticated traders employ advanced strategies to capitalize on the nuances of each market phase. These strategies often involve a combination of technical analysis, fundamental analysis, and a keen awareness of intermarket correlations.

Breakout Trading During Session Openings

The opening of a major trading session frequently witnesses significant price movements as market participants react to overnight news and economic data. Breakout strategies, therefore, can be particularly effective during these periods. However, it is imperative to exercise caution and implement robust risk management protocols, as false breakouts are also common.

Fading the Initial Move

Conversely, some traders prefer to fade the initial price movement following a session opening. This strategy is predicated on the assumption that the initial move is often driven by speculative activity and may not be sustainable. By identifying overbought or oversold conditions, traders can capitalize on potential reversals.

Important Consideration: Always backtest any trading strategy thoroughly before deploying it in a live trading environment. Historical performance is not necessarily indicative of future results, but it provides valuable insights into the strategy’s potential profitability and risk profile.

The Impact of Economic News Releases on Forex Market Hours

Economic news releases exert a profound influence on currency valuations, often triggering substantial volatility and price swings. Understanding the timing of these releases and their potential impact is crucial for effective risk management and strategic decision-making.

Scheduled Economic Data

Major economic indicators, such as GDP growth, inflation rates, and employment figures, are typically released according to a pre-determined schedule. Traders should consult economic calendars to stay informed about upcoming releases and their expected impact on specific currency pairs.

Unscheduled Events

Unforeseen events, such as geopolitical crises or unexpected policy announcements, can also significantly impact the Forex market. While these events are inherently unpredictable, traders should remain vigilant and prepared to react swiftly to changing market conditions.

Technology and Tools for Monitoring Forex Market Hours

In today’s fast-paced trading environment, technology plays a critical role in monitoring Forex market hours and executing trades efficiently. A variety of tools and platforms are available to assist traders in this endeavor.

- Forex Market Hour Clocks: These tools visually display the opening and closing times of different trading sessions in real-time.

- Economic Calendars: As previously mentioned, economic calendars provide a comprehensive schedule of upcoming economic news releases.

- Trading Platforms: Modern trading platforms offer advanced charting capabilities, real-time news feeds, and automated trading functionalities.

Selecting the right tools and platforms is essential for maximizing trading efficiency and minimizing the risk of errors.

Risk Management Considerations Related to Forex Market Hours

Effective risk management is paramount in Forex trading, and understanding the nuances of market hours is an integral component of a robust risk management strategy.

Volatility Management

Adjust position sizes and stop-loss orders based on the volatility levels associated with different trading sessions. Higher volatility necessitates smaller position sizes and tighter stop-loss orders.

Slippage Mitigation

Slippage, the difference between the expected price of a trade and the actual price at which it is executed, is more likely to occur during periods of high volatility and low liquidity; Employ limit orders to mitigate the risk of slippage.

Overnight Risk

Holding positions overnight exposes traders to the risk of adverse price movements due to news events or unexpected market developments. Consider closing positions before the market closes or using guaranteed stop-loss orders to limit potential losses.