Forex trading can feel like navigating a complex maze, right? With so many strategies and techniques out there, it’s easy to get overwhelmed. But what if there was a way to potentially double your chances of success, or at least learn valuable lessons from both winning and losing trades simultaneously? That’s where twin trading comes in. It’s a fascinating approach that involves opening two similar but slightly different positions on the same currency pair. Let’s dive into what twin trading is all about and how it works.

Understanding Twin Trading in Forex

Twin trading, at its core, involves opening two correlated positions on the same currency pair. Think of it as running two parallel experiments. The idea is to capitalize on market movements while also hedging your bets and learning from the contrasting outcomes of each trade.

But why would someone do this? Well, there are a few potential benefits:

- Risk Management: It allows you to manage risk by diversifying your approach.

- Learning Opportunity: You can compare the performance of two slightly different strategies in real-time.

- Potential for Profit: If one trade performs well, it can offset losses from the other, potentially leading to overall profit.

How Does Twin Trading in Forex Actually Work?

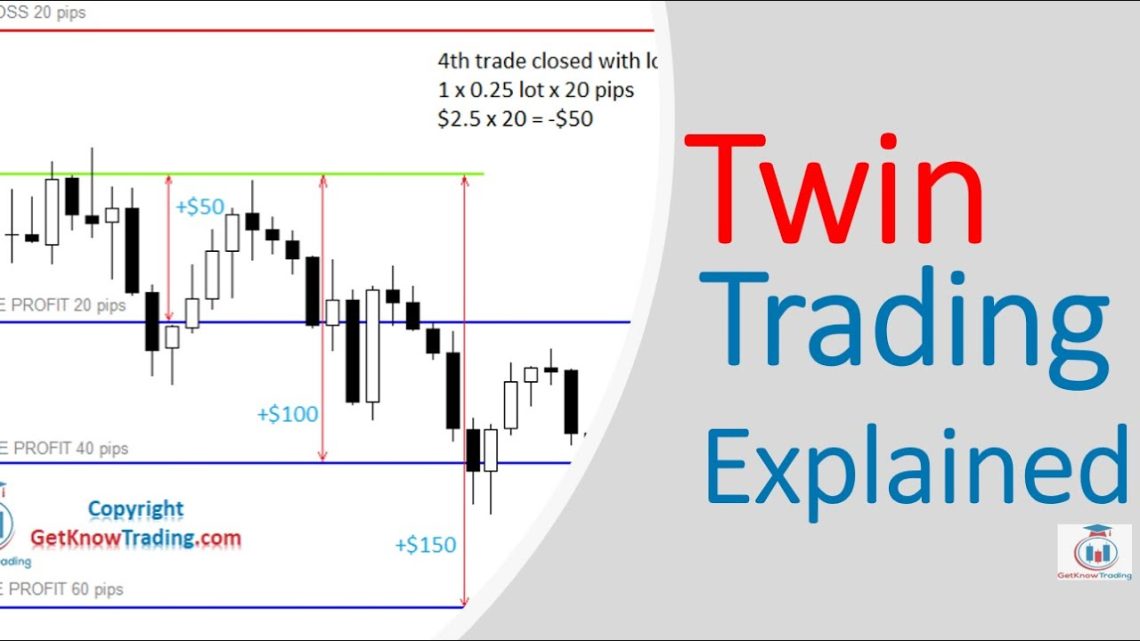

Okay, so how does this actually play out in the real world? Let’s say you believe the EUR/USD pair is going to increase in value. You might open two buy (long) positions, but with slight variations. Here’s a simple example:

- Trade 1: Buy EUR/USD with a tight stop-loss and a moderate take-profit;

- Trade 2: Buy EUR/USD with a wider stop-loss and a more ambitious take-profit.

The key is to adjust parameters like stop-loss levels, take-profit targets, or even the entry points slightly. This allows you to test different risk-reward ratios and see which performs better under specific market conditions.

Implementing a Twin Trading Strategy in Forex

Implementing a twin trading strategy requires careful planning and execution. It’s not just about randomly opening two trades and hoping for the best. Here are some key considerations:

Choosing Your Currency Pair for Twin Trading

Select a currency pair that you are familiar with and that exhibits sufficient volatility. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are often good choices due to their high liquidity and relatively predictable behavior.

Setting Stop-Loss and Take-Profit Levels in Twin Trading

This is where the magic happens! Experiment with different stop-loss and take-profit levels for each trade. For example, you could use a tighter stop-loss on one trade to protect your capital, while using a wider stop-loss on the other to allow for more market fluctuation.

Managing Risk with Twin Trading

Risk management is crucial. Determine the maximum amount you are willing to risk on each trade and adjust your position sizes accordingly. Remember, the goal is to learn and potentially profit, not to blow your account.

The Pros and Cons of Twin Trading in Forex

Like any trading strategy, twin trading has its advantages and disadvantages. Let’s weigh them out:

Advantages of Twin Trading

- Enhanced Learning: Provides a direct comparison of different trading parameters.

- Potential Risk Mitigation: Can help offset losses if one trade goes against you.

- Flexibility: Allows you to adapt to changing market conditions.

Disadvantages of Twin Trading

- Increased Complexity: Requires more attention and analysis than single-trade strategies.

- Potential for Higher Losses: If both trades go wrong, losses can be significant.

- Requires More Capital: You need enough capital to open and manage two positions simultaneously.

Is Twin Trading in Forex Right for You?

Ultimately, the decision of whether or not to use twin trading depends on your individual trading style, risk tolerance, and experience level. Are you comfortable managing multiple positions simultaneously? Do you have a solid understanding of risk management principles? If so, twin trading might be worth exploring. However, if you are new to forex trading, it’s best to start with simpler strategies and gradually work your way up to more complex techniques like twin trading.

FAQ About Twin Trading in Forex

What level of experience is needed for twin trading?

Twin trading is best suited for traders with some experience in forex, as it requires a good understanding of risk management and market analysis.

Can twin trading guarantee profits?

No, no trading strategy can guarantee profits. Twin trading is a tool that can potentially enhance your trading skills and risk management, but it doesn’t eliminate the risk of losses.

Is twin trading considered hedging?

While it can act as a form of hedging, twin trading is more about exploring different trading parameters and learning from the contrasting outcomes of each trade.

So, there you have it – a glimpse into the world of twin trading in forex. It’s a strategy that offers both potential rewards and risks. Remember to approach it with caution, practice diligently, and always prioritize risk management. Trading is a journey, not a sprint, and every strategy you learn is another tool in your arsenal. Good luck, and happy trading!