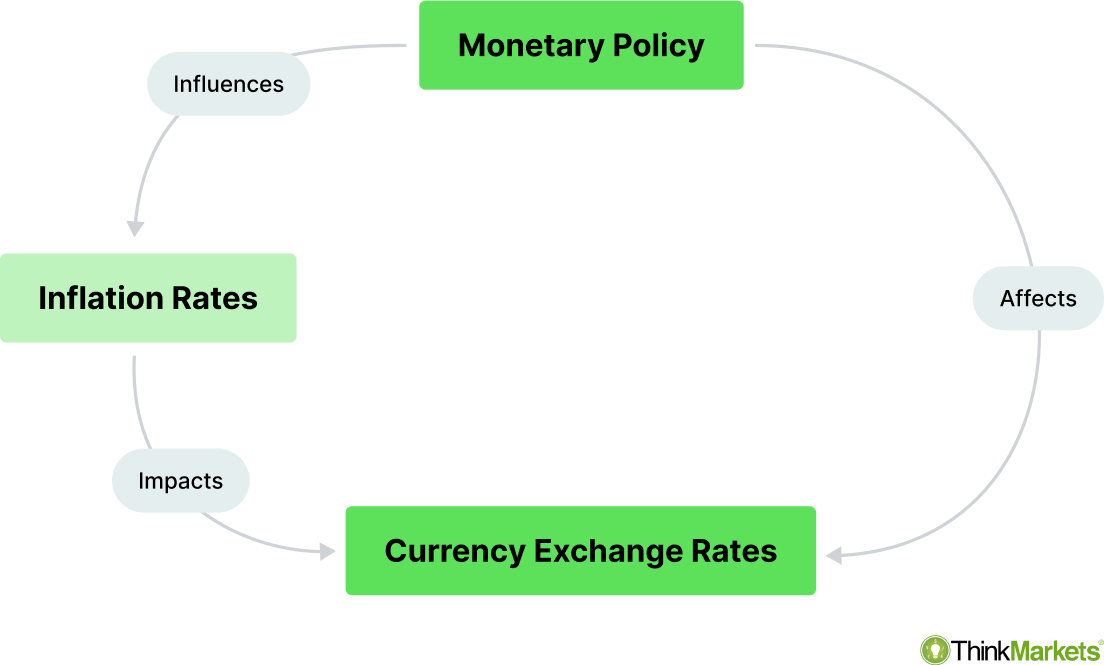

Ever wondered what really moves the Forex market? It’s not just random fluctuations; often, the invisible hand of monetary policy is at play. Understanding how central banks influence currency values can be a game-changer for your trading strategy. Let’s dive into the fascinating world where interest rates, inflation targets, and economic growth all intertwine to shape the Forex landscape. This article will break down the key concepts and provide actionable insights to help you navigate the complexities of Forex trading with confidence. Ready to demystify the connection between monetary policy and Forex?

Monetary policy, in essence, is how a central bank manages the money supply and credit conditions to stimulate or restrain economic activity. It’s a powerful tool, and its effects ripple through the financial markets, especially Forex. But how exactly does it work?

Think of it like this: a central bank is like the conductor of an orchestra (the economy). By adjusting interest rates, they can speed up or slow down the tempo. Lower interest rates encourage borrowing and spending, while higher rates do the opposite. These changes have a direct impact on currency values.

Interest Rates: A Key Driver of Forex Trading

Interest rates are arguably the most significant factor influencing currency values. Higher interest rates generally attract foreign investment, increasing demand for the local currency and causing it to appreciate. Conversely, lower interest rates can make a currency less attractive, leading to depreciation.

How Interest Rate Decisions Affect Forex Trading

Central bank announcements regarding interest rates are closely watched by Forex traders. Any unexpected change or even a hint of a future change can trigger significant market movements. For example:

- Surprise Rate Hike: If a central bank unexpectedly raises interest rates, the currency is likely to strengthen.

- Dovish Statement: If a central bank signals that it may lower interest rates in the future (a “dovish” stance), the currency may weaken.

It’s crucial to stay informed about upcoming central bank meetings and announcements to anticipate potential market volatility. Are you ready to interpret the signals?

Tip: Use an economic calendar to track important monetary policy announcements. This will help you prepare for potential market swings.

Inflation Targets and Forex Trading Strategies

Central banks often set inflation targets to maintain price stability. These targets influence monetary policy decisions, which, in turn, affect Forex rates. If inflation is above the target, the central bank may raise interest rates to cool down the economy, strengthening the currency. If inflation is below the target, they may lower rates to stimulate growth, potentially weakening the currency.

How Inflation Data Impacts Forex Trading

Traders closely monitor inflation data releases (e.g., CPI, PPI) to gauge the likelihood of future interest rate changes. Stronger-than-expected inflation data may lead traders to anticipate rate hikes, while weaker data may suggest rate cuts.

- High Inflation: Signals potential interest rate hikes, strengthening the currency.

- Low Inflation: Signals potential interest rate cuts, weakening the currency.

Understanding the relationship between inflation and monetary policy is essential for developing effective Forex trading strategies. Do you know how to read the inflation tea leaves?

Quantitative Easing (QE) and Forex Trading

Quantitative easing (QE) is a less conventional monetary policy tool used by central banks to stimulate the economy when interest rates are already near zero. It involves a central bank injecting liquidity into the money supply by purchasing assets, such as government bonds. QE can have a complex effect on Forex rates.

The Impact of QE on Currency Values

Generally, QE tends to weaken a currency because it increases the money supply. However, the actual impact can depend on various factors, including the scale of the QE program, the economic conditions in the country, and the actions of other central banks.

Interesting Fact: Sometimes, a QE announcement can initially weaken a currency, but if it leads to improved economic growth, the currency may eventually strengthen.

Other Factors Influencing Forex Trading Besides Monetary Policy

While monetary policy is a major driver, it’s not the only factor affecting Forex rates. Other important considerations include:

- Economic Growth: Strong economic growth generally supports a currency.

- Political Stability: Political uncertainty can weaken a currency.

- Geopolitical Events: Global events, such as trade wars or conflicts, can cause significant market volatility.

- Market Sentiment: Overall investor confidence or fear can influence currency flows.

A holistic approach that considers all these factors is crucial for successful Forex trading. Are you ready to look beyond the headlines?

FAQ: Monetary Policy and Forex Trading

How often do central banks announce monetary policy decisions?

The frequency varies by central bank, but most announce decisions every 6-8 weeks.

Where can I find information about upcoming monetary policy announcements?

Economic calendars are readily available online and on financial news websites.

Is it possible to predict the exact impact of monetary policy on Forex?

No, it’s not an exact science. Many factors influence Forex rates, making precise predictions difficult.

What is the best way to trade Forex based on monetary policy?

Stay informed, analyze the data, and manage your risk carefully. There’s no guaranteed winning strategy.