Forex trading, the exciting world of currency exchange, can seem daunting at first. You’re probably wondering about all sorts of hidden costs and fees. Is it going to nickel and dime you to death? One common question that pops up is: “Does forex have a monthly fee?” Let’s dive into the details and clear up any confusion. We’ll explore the different types of fees you might encounter and help you understand what to expect when you start trading forex.

The short answer is, generally, no. Most forex brokers don’t charge a direct monthly fee just to have an account. However, that doesn’t mean trading is entirely free. Instead of monthly fees, brokers typically make their money through other charges. Let’s break down the common fee structures you might encounter.

Spreads: The Most Common Forex Fee

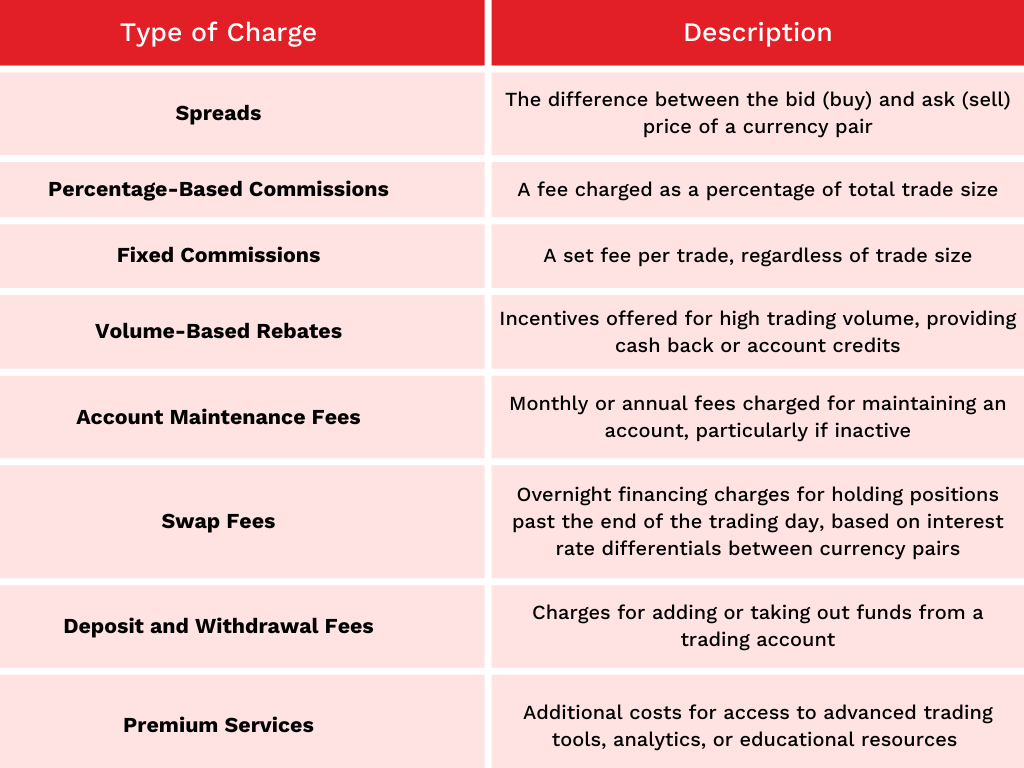

The spread is the difference between the buying price (ask) and the selling price (bid) of a currency pair. It’s essentially the broker’s commission on each trade. A tighter spread means lower costs for you. For example, if the EUR/USD bid price is 1.1000 and the ask price is 1.1002, the spread is 2 pips. This is the most common way brokers make their money.

Tip: Pay close attention to the spreads offered by different brokers. Even small differences can add up over time, especially if you’re a frequent trader.

Commission-Based Accounts

Some brokers offer commission-based accounts. Instead of a wider spread, they charge a fixed commission for each trade you make. This can be beneficial for high-volume traders. Consider this: you might pay $5 per lot traded. It really depends on your trading style to determine which is better for you.

Other Potential Forex Fees to Watch Out For

While monthly fees are rare, other fees can sneak up on you if you’re not careful. It’s important to be aware of these potential costs.

Inactivity Fees

Some brokers charge inactivity fees if you don’t trade for a certain period. This is usually a monthly fee that kicks in after several months of inactivity. Make sure to check the broker’s terms and conditions to avoid this fee. Are you planning on taking a long break? Consider closing your account or making a small trade to keep it active.

Withdrawal Fees

Brokers may charge fees for withdrawing funds from your account. The fee amount can vary depending on the withdrawal method. Bank transfers often have higher fees than e-wallets. Always check the withdrawal fee structure before choosing a broker.

Overnight Funding or Swap Fees

If you hold a position overnight, you may be charged a swap fee (also known as an overnight funding fee). This fee is based on the interest rate differential between the two currencies in the pair you’re trading. It can be either a debit or a credit to your account. Are you a day trader? Then this likely won’t affect you.

Deposit Fees

While less common, some brokers might charge fees for depositing funds into your account, especially if using certain payment methods. Always verify the deposit fee policy.

- Inactivity Fees

- Withdrawal Fees

- Overnight Funding (Swap) Fees

- Deposit Fees (Less Common)

Choosing the Right Forex Broker: Minimizing Forex Fees

Selecting the right broker is crucial to minimizing your trading costs. Here are some factors to consider when choosing a broker.

Compare Spreads and Commissions

Compare the spreads and commissions offered by different brokers. Consider your trading style and volume to determine which fee structure is more advantageous. A good broker will be transparent about their fees.

Check for Hidden Fees

Read the broker’s terms and conditions carefully to identify any hidden fees. Pay attention to inactivity fees, withdrawal fees, and any other potential charges. Don’t be afraid to ask questions!

Consider Account Types

Brokers often offer different account types with varying fee structures; Choose an account type that aligns with your trading needs and experience level. A beginner might prefer a standard account with slightly wider spreads, while an experienced trader might opt for a commission-based account with tighter spreads.

Interesting Fact: Some brokers offer “ECN” (Electronic Communication Network) accounts, which provide direct access to the interbank market. These accounts typically have very tight spreads but charge a commission per trade.

Read Reviews and Do Your Research

Before choosing a broker, read reviews and do your research to ensure they are reputable and reliable. Look for brokers that are regulated by reputable financial authorities. Regulation is key to protecting your funds.

- Compare Spreads and Commissions

- Check for Hidden Fees

- Consider Account Types

- Read Reviews and Do Your Research

Frequently Asked Questions About Forex Fees

So, while you likely won’t encounter a straightforward monthly fee in forex trading, understanding the other potential costs is crucial. By being informed and choosing the right broker, you can minimize your expenses and maximize your trading profits. Remember to always do your research and trade responsibly. Happy trading! Don’t let hidden fees eat into your potential profits. Good luck out there!