The Forex market moves fast. Really fast. Trying to keep up with every fluctuation, every news announcement, and every potential trading opportunity can feel like a full-time job. That’s where Forex alerts come in. They’re like having a little helper constantly watching the market for you, ready to ping you when something important happens. But how do you actually get these alerts, and more importantly, how do you make sure they’re reliable? Let’s dive in and explore the world of Forex alerts, so you can trade smarter, not harder.

So, what exactly are Forex alerts? Simply put, they are notifications that inform you about specific market conditions or potential trading opportunities. These alerts can be based on a variety of factors, such as price movements, technical indicators, or economic news releases. Think of them as your personal market radar, helping you stay informed without being glued to your screen 24/7.

Different Types of Forex Alerts

There are several types of Forex alerts available, each catering to different trading styles and preferences. Understanding these differences is key to choosing the right alerts for you.

- Price Alerts: These are triggered when a currency pair reaches a specific price level. For example, you might set an alert if EUR/USD hits 1.1000.

- Technical Indicator Alerts: These alerts are based on technical indicators like moving averages, RSI, or MACD. They notify you when a specific indicator signals a potential buy or sell opportunity.

- Economic News Alerts: These alerts inform you about upcoming economic news releases, such as GDP figures or interest rate decisions, which can significantly impact the Forex market.

- Custom Alerts: Many platforms allow you to create custom alerts based on your own specific criteria. This gives you maximum flexibility and control.

Tip: Don’t rely solely on alerts. Always do your own research and analysis before making any trading decisions. Alerts are a tool, not a magic bullet!

Choosing the Right Forex Alert Provider

Not all Forex alert providers are created equal. Some are highly accurate and reliable, while others are… well, let’s just say they’re less than helpful. Choosing the right provider is crucial to your trading success. So, how do you separate the good from the bad?

Factors to Consider When Choosing a Forex Alert Provider

Here are some key factors to keep in mind when evaluating different Forex alert providers:

- Accuracy: How often are the alerts correct? Look for providers with a proven track record of accuracy.

- Reliability: Are the alerts delivered promptly and consistently? Delays can mean missed opportunities.

- Customization: Can you customize the alerts to fit your specific trading needs? The more control you have, the better.

- Cost: What is the pricing structure? Are there any hidden fees? Make sure the cost is justified by the value you receive.

- Reviews and Reputation: What do other traders say about the provider? Check online reviews and forums to get a sense of their reputation.

Do your homework! A little research can save you a lot of time and money in the long run.

Setting Up Forex Alerts on Your Trading Platform

Once you’ve chosen a Forex alert provider, the next step is to set up the alerts on your trading platform. The exact process will vary depending on the platform you’re using, but the general principles are the same.

Step-by-Step Guide to Setting Up Forex Alerts

Here’s a general guide to setting up Forex alerts on most trading platforms:

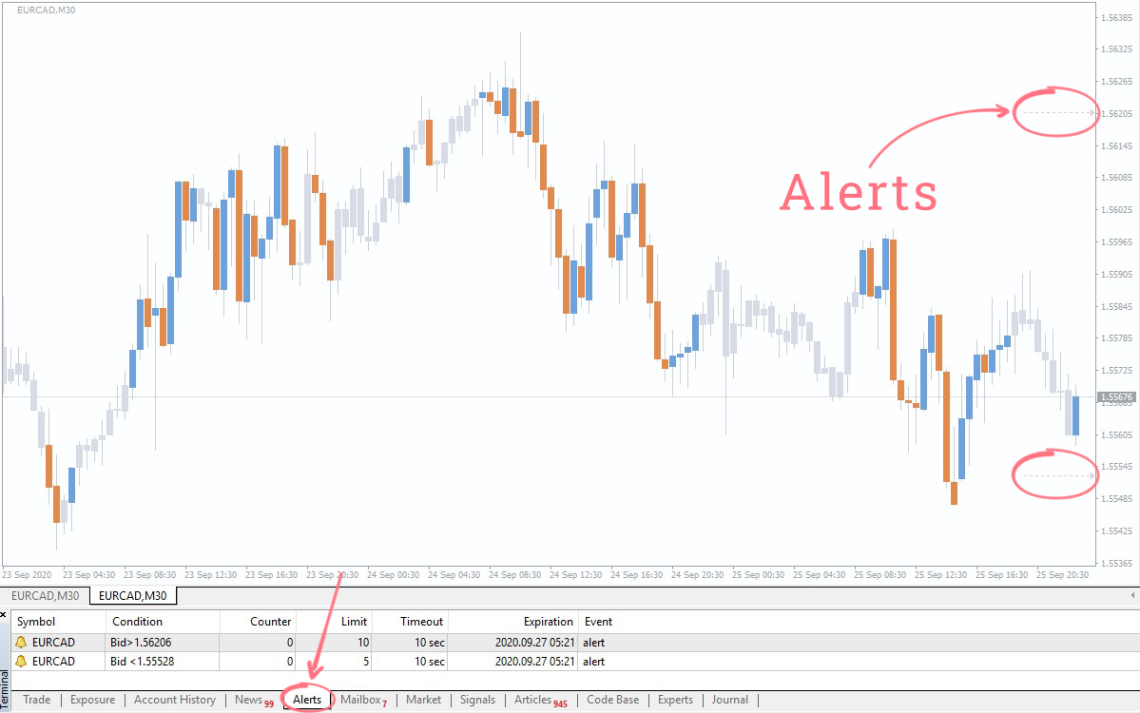

- Log in to your trading platform.

- Navigate to the “Alerts” or “Notifications” section. This is usually found in the settings menu or control panel.

- Create a new alert. You’ll typically need to specify the currency pair, the alert type (e.g., price alert, indicator alert), and the trigger conditions (e.g., price level, indicator value).

- Set the notification method. Choose how you want to receive the alerts (e.g., email, SMS, push notification).

- Save the alert. Once you’ve configured the alert, save it to activate it.

Interesting Fact: Many brokers now offer integrated alert systems directly within their trading platforms, making it easier than ever to stay informed.

Managing and Optimizing Your Forex Alerts

Setting up alerts is just the beginning. To get the most out of them, you need to manage and optimize them regularly. This means:

- Reviewing your alerts periodically. Are they still relevant to your trading strategy?

- Adjusting the trigger conditions. As market conditions change, you may need to adjust the alert settings.

- Removing outdated or irrelevant alerts. Clutter can lead to missed opportunities.

The Pros and Cons of Using Forex Alerts

Like any trading tool, Forex alerts have their advantages and disadvantages. It’s important to be aware of both sides before relying on them.

Advantages of Forex Alerts

- Save Time: Alerts free you from having to constantly monitor the market.

- Identify Opportunities: They can help you spot potential trading opportunities you might otherwise miss.

- Stay Informed: Alerts keep you up-to-date on important market developments.

- Improve Efficiency: By automating the monitoring process, alerts can make your trading more efficient.

Disadvantages of Forex Alerts

- False Signals: Alerts can sometimes generate false signals, leading to bad trades.

- Over-Reliance: Relying too heavily on alerts can lead to a lack of independent analysis.

- Information Overload: Too many alerts can be overwhelming and distracting.

- Cost: Some alert providers charge a fee for their services.

Ultimately, the decision of whether or not to use Forex alerts is a personal one. Weigh the pros and cons carefully and decide what’s right for you.

FAQ: Frequently Asked Questions About Forex Alerts

Are Forex alerts worth it?

Whether Forex alerts are “worth it” depends on your trading style, experience level, and budget. If you’re a busy trader who can’t constantly monitor the market, alerts can be a valuable tool. However, it’s crucial to choose a reliable provider and not rely solely on alerts without doing your own research.

Can Forex alerts guarantee profits?

No, Forex alerts cannot guarantee profits. The Forex market is inherently risky, and no alert system can predict the future with 100% accuracy. Alerts should be used as a tool to supplement your own analysis, not as a substitute for it.

What is the best Forex alert app?

The “best” Forex alert app is subjective and depends on your individual needs and preferences. Some popular options include MetaTrader 4/5 (with custom alerts), TradingView, and various third-party alert providers. It’s best to try out a few different options and see which one works best for you.

Are free Forex alerts reliable?

While there are some reliable free Forex alert services available, it’s generally true that you get what you pay for. Free alerts may be less accurate, less reliable, or have limited features compared to paid services. Be cautious when using free alerts and always verify the information with your own analysis.

Forex alerts can be a powerful tool in your trading arsenal, but they’re not a magic bullet. Remember to choose a reliable provider, customize your alerts to fit your trading style, and always do your own research before making any trading decisions. Don’t let the allure of instant information replace sound judgment and disciplined analysis. Trading success requires a balanced approach, and Forex alerts are just one piece of the puzzle. Now go forth and trade wisely!