Ever wondered what it really means when someone says they’re “investing in a company?” It’s more than just throwing money at a business and hoping for the best. It’s about becoming a part-owner, sharing in the potential profits (and sometimes, the losses), and contributing to the growth of something bigger than yourself. This guide breaks down the core concepts, clarifies the jargon, and helps you understand the exciting world of company investment. So, are you ready to dive in and explore the possibilities?

Understanding the Basics of Investing in a Company

At its heart, investing in a company means providing capital to that company in exchange for a share of its ownership. This ownership is typically represented by shares of stock. When you buy stock, you’re essentially buying a small piece of the company. But what does that actually mean for you?

Why Companies Seek Investment

Companies seek investment for various reasons. They might need funds to:

- Expand their operations into new markets.

- Develop new products or services.

- Hire more employees.

- Pay off existing debt.

Essentially, investment fuels growth and allows companies to achieve their goals. Without investment, many companies would struggle to survive and thrive.

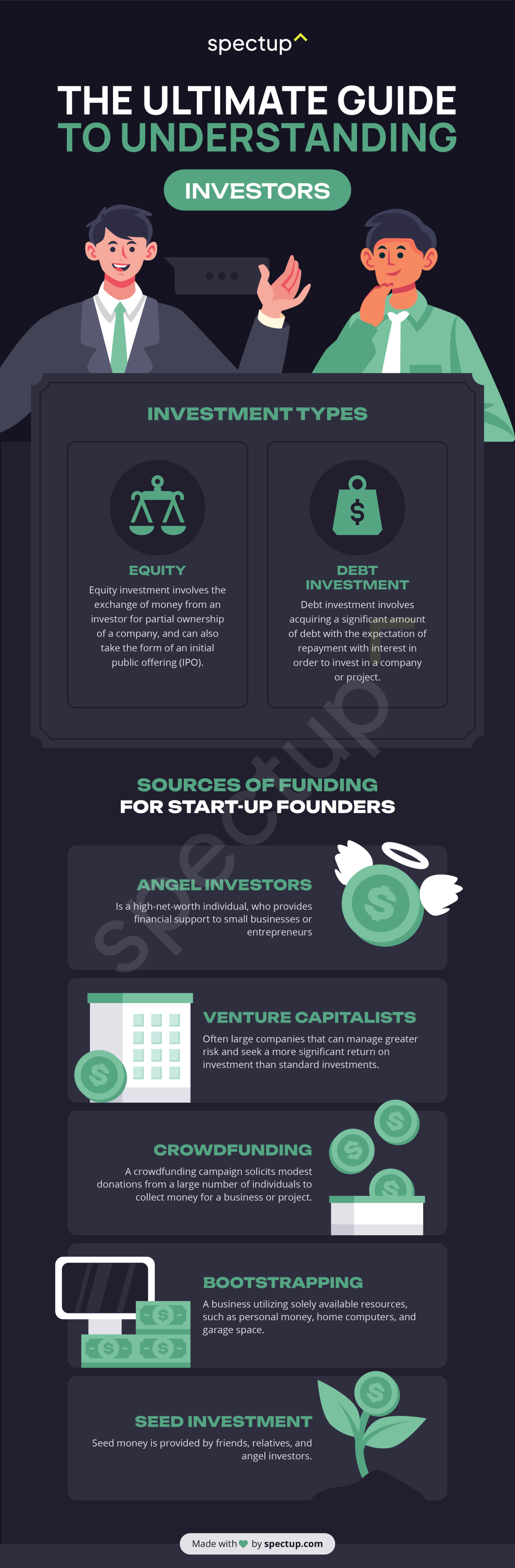

Different Ways of Investing in a Company

There are several avenues you can take when investing in a company. Each has its own risk and reward profile. Let’s explore some common methods:

Buying Stocks (Shares)

This is perhaps the most well-known way to invest. You purchase shares of a company on the stock market. The price of the stock fluctuates based on market demand and the company’s performance. If the company does well, the value of your shares increases. If it struggles, the value decreases. It’s a direct way to participate in the company’s success (or failure).

Investing in Bonds

When you buy a company’s bonds, you’re essentially lending them money. The company promises to repay the principal amount of the bond, plus interest, over a specified period. Bonds are generally considered less risky than stocks, but they also offer lower potential returns.

Venture Capital and Private Equity

These involve investing in privately held companies that aren’t publicly traded on the stock market. Venture capital typically focuses on early-stage companies with high growth potential, while private equity invests in more established businesses. These investments are generally illiquid (meaning they can’t be easily sold) and carry significant risk, but they also offer the potential for substantial returns.

The Risks and Rewards of Investing in a Company

Investing is never a guaranteed path to riches. It’s crucial to understand both the potential rewards and the inherent risks involved. What are you willing to risk to potentially gain?

Potential Rewards

- Capital Appreciation: The value of your investment increases over time.

- Dividends: Some companies pay out a portion of their profits to shareholders in the form of dividends.

- Influence: As a shareholder, you may have the right to vote on important company matters.

Potential Risks

- Loss of Investment: The value of your investment could decrease, and you could lose some or all of your money.

- Market Volatility: Stock prices can fluctuate wildly, making it difficult to predict short-term returns.

- Company Performance: A company’s financial performance can impact the value of its stock.

Doing Your Due Diligence Before Investing in a Company

Before you invest in any company, it’s essential to do your homework. This involves researching the company’s financials, understanding its business model, and assessing its competitive landscape. Don’t just rely on gut feelings or tips from friends. Informed decisions are always the best decisions.

Key Areas to Research

- Financial Statements: Analyze the company’s income statement, balance sheet, and cash flow statement.

- Industry Analysis: Understand the industry the company operates in and its competitive position;

- Management Team: Assess the experience and track record of the company’s leadership.

Investing in a Company: A Long-Term Perspective

Investing is often a marathon, not a sprint. It’s generally best to adopt a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Think about your goals and how this investment fits into your overall financial plan. Are you saving for retirement? A down payment on a house? Understanding your timeline will help you make smarter investment choices.

FAQ: Investing in a Company

What is a stock split?

A stock split is when a company increases the number of its outstanding shares by issuing more shares to current shareholders. This lowers the price of each individual share, making it more accessible to a wider range of investors. The overall value of your holdings remains the same, but you own more shares at a lower price.

What are dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. Not all companies pay dividends, but those that do often do so on a regular basis (e.g., quarterly or annually). Dividends can be a good source of income for investors.

What is the difference between common stock and preferred stock?

Common stock gives you voting rights in the company, while preferred stock typically doesn’t. However, preferred stockholders usually have priority over common stockholders when it comes to receiving dividends and assets in the event of liquidation.

How do I buy stocks?

You can buy stocks through a brokerage account. There are many online brokers to choose from, offering different features and fee structures. Research different brokers and choose one that meets your needs.

What is a bear market?

A bear market is a period of sustained decline in stock prices, typically defined as a 20% or more drop from a recent high. Bear markets can be scary, but they also present opportunities to buy stocks at lower prices.

Investing in a company can be a powerful way to grow your wealth and participate in the success of businesses you believe in. However, it’s crucial to approach it with knowledge, caution, and a long-term perspective. Remember to do your research, understand the risks, and diversify your portfolio. Investing is a journey, not a destination, so enjoy the ride and learn along the way. With the right approach, you can unlock the potential of company investment and build a brighter financial future. So, take that first step, explore the possibilities, and start investing in your future today.