Credit cards, once a symbol of financial freedom and purchasing power, are facing a growing wave of consumer reluctance. It’s a fascinating shift, isn’t it? What was once a staple in almost every wallet is now being questioned, avoided, and even actively rejected by a significant portion of the population. But why is this happening? Let’s delve into the reasons behind this change in consumer behavior and explore the factors contributing to the decline in credit card popularity.

The Burden of Debt: Why Consumers Avoid Credit Cards

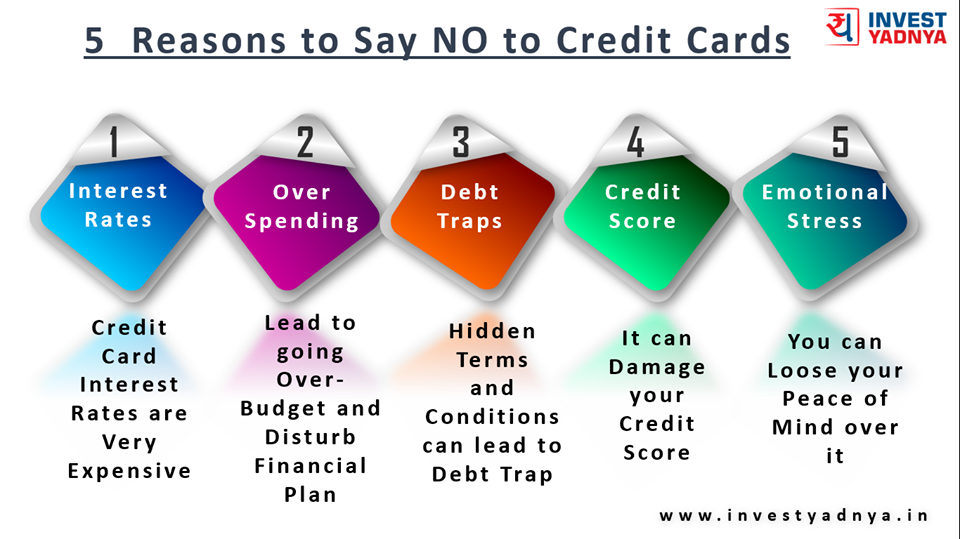

One of the most significant reasons consumers are shying away from credit cards is the fear of accumulating debt. It’s a valid concern, isn’t it? The allure of instant gratification can quickly lead to overspending and a mountain of debt that feels impossible to climb. High interest rates exacerbate the problem, turning small purchases into long-term financial burdens. It’s easy to see why people are wary.

Consider this: a seemingly small balance on a credit card can balloon over time due to interest charges. This can significantly impact your financial well-being. Many people are actively trying to avoid this trap.

The Impact of High Interest Rates on Credit Card Usage

High interest rates are a major deterrent for many consumers. They understand that even if they make minimum payments, a large portion of that money goes towards interest, not the principal. This can lead to a feeling of being stuck in a never-ending cycle of debt. It’s a frustrating situation, to say the least.

Alternatives to Credit Cards: Shifting Consumer Preferences

The rise of alternative payment methods is also contributing to the decline in credit card usage. Consumers now have a plethora of options at their fingertips, from debit cards and digital wallets to buy-now-pay-later services. These alternatives often offer more control and transparency, making them attractive to those who are wary of credit card debt.

- Debit Cards: Offer a direct link to your bank account, preventing overspending.

- Digital Wallets (e.g., Apple Pay, Google Pay): Provide a convenient and secure way to make payments.

- Buy-Now-Pay-Later Services (BNPL): Allow you to spread out payments over time without accruing interest (if paid on time).

Debit Cards and Digital Wallets: A Safer Way to Spend?

Debit cards and digital wallets offer a sense of security and control that credit cards sometimes lack. You’re only spending money you actually have, which eliminates the risk of accumulating debt. This is a major draw for many consumers, especially those who have struggled with credit card debt in the past.

The Complexity of Credit Card Terms: Why Consumers are Confused

Let’s face it, credit card agreements can be confusing and overwhelming. Hidden fees, complicated reward programs, and ever-changing terms and conditions can leave consumers feeling frustrated and distrustful. This lack of transparency can lead to a reluctance to use credit cards altogether.

Consider the fine print. Have you ever actually read through all the terms and conditions of your credit card agreement? Probably not, right? It’s a daunting task, and many consumers simply don’t have the time or patience to decipher the legalese.

Transparency and Simplicity: What Consumers Really Want from Credit Cards

Consumers are craving transparency and simplicity when it comes to financial products. They want to understand exactly what they’re signing up for and avoid any unexpected surprises. Credit card companies that prioritize clarity and simplicity are more likely to attract and retain customers.

- Clear and concise terms and conditions

- Easy-to-understand fee structures

- Transparent reward programs

The Rise of Financial Awareness: Empowering Consumers to Make Informed Choices

There’s a growing trend of financial awareness and education among consumers. People are becoming more proactive about managing their finances and making informed decisions about their spending habits. This increased awareness is leading many to question the necessity of credit cards and explore alternative options.

Are you actively managing your budget? Are you tracking your spending? More and more people are saying “yes” to these questions, and that’s a good thing! Financial awareness empowers consumers to take control of their financial lives.

Financial Education and Credit Card Usage: A Direct Correlation?

Studies have shown a direct correlation between financial education and responsible credit card usage. The more people understand about credit cards, the better equipped they are to use them wisely and avoid debt. This highlights the importance of promoting financial literacy initiatives.

FAQ: Credit Card Concerns

Q: Are credit cards inherently bad?

A: Not necessarily. When used responsibly, credit cards can offer benefits like building credit, earning rewards, and providing purchase protection. However, they can also lead to debt if not managed carefully.

Q: What are the alternatives to credit cards?

A: Debit cards, digital wallets, and buy-now-pay-later services are popular alternatives.

Q: How can I use credit cards responsibly?

A: Pay your balance in full each month, avoid overspending, and understand the terms and conditions of your card.

Q: What if I’m already in credit card debt?

A: Create a budget, prioritize paying down high-interest debt, and consider seeking help from a credit counseling agency.