The question of whether politicians should be allowed to invest in the stock market is a complex and controversial one. On one hand, it’s argued that restricting investment opportunities could unfairly limit their financial freedom; After all, shouldn’t they have the same rights as any other citizen? On the other hand, the potential for conflicts of interest and insider trading raises serious ethical concerns. This debate touches upon fundamental principles of fairness, transparency, and public trust. Let’s delve deeper into the arguments surrounding this important issue.

The Core Debate: Politicians and Stock Market Investments

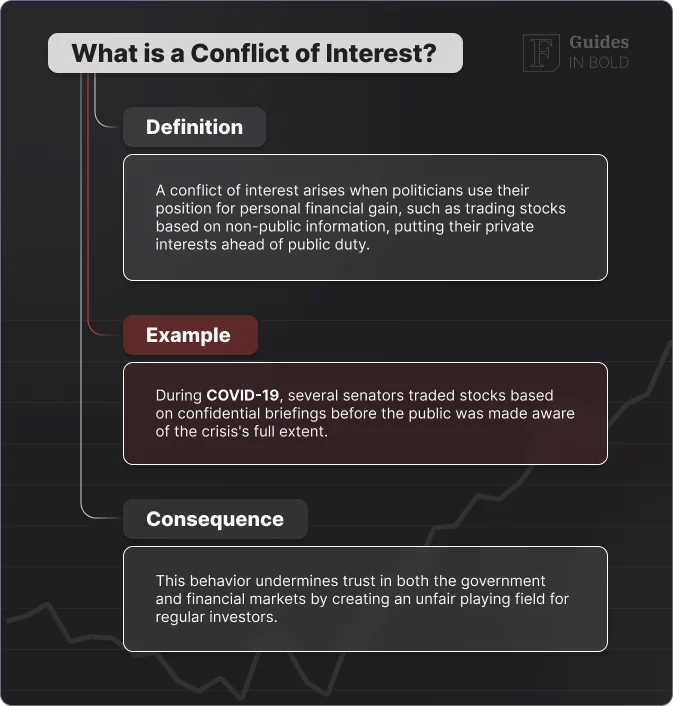

At the heart of this debate lies the potential for abuse. Politicians often have access to non-public information that could significantly impact stock prices. This creates a temptation to use that information for personal gain, a practice known as insider trading.

Understanding Potential Conflicts of Interest

Imagine a senator sitting on a committee that’s about to vote on a bill regulating a specific industry. If that senator owns stock in companies within that industry, their vote could be influenced by their personal financial interests. Is that fair to the public? Is it ethical?

Tip: Always consider the source of information when evaluating arguments about political ethics. Are they biased? What’s their agenda?

- Access to non-public information

- Potential for insider trading

- Influence on policy decisions

Arguments in Favor of Allowing Politicians to Invest

It’s not all doom and gloom. Some argue that restricting politicians’ investment opportunities is overly restrictive and potentially discriminatory. They believe that with proper disclosure and oversight, the risks can be managed.

The Right to Financial Freedom

Proponents of allowing politicians to invest often emphasize their right to manage their own finances. They argue that as long as investments are properly disclosed and comply with existing laws against insider trading, there’s no inherent reason to prohibit them.

Promoting Financial Literacy

Some even suggest that allowing politicians to invest could encourage them to become more knowledgeable about the economy and financial markets, which could ultimately lead to better policy decisions. A financially literate politician might be better equipped to understand the impact of their decisions on the economy.

Arguments Against Politicians Investing in the Stock Market

The opposing view is much stronger, focusing on the inherent conflicts of interest and the erosion of public trust. This perspective emphasizes the need for strict regulations to prevent abuse and maintain the integrity of the political system.

Erosion of Public Trust

When politicians are perceived as profiting from their positions, it can severely damage public trust in government. This can lead to cynicism, disengagement, and a decline in civic participation. Can a democracy truly function when its citizens don’t trust their leaders?

The STOCK Act: A Step in the Right Direction?

The STOCK Act (Stop Trading on Congressional Knowledge Act) was passed in 2012 to address insider trading by members of Congress. It requires them to disclose their stock trades and prohibits them from using non-public information for personal gain. However, some argue that it doesn’t go far enough.

Interesting Fact: The STOCK Act was passed with overwhelming bipartisan support, demonstrating a widespread recognition of the need to address insider trading in Congress.

- Conflicts of interest are almost unavoidable.

- The perception of corruption can be just as damaging as actual corruption.

- Enforcement of existing laws can be challenging.

Potential Solutions and Regulations for Politicians Investing in the Stock Market

So, what’s the answer? Is there a middle ground? Perhaps. There are several potential solutions that could mitigate the risks while still allowing politicians to participate in the financial markets.

Blind Trusts

One option is requiring politicians to place their assets in a blind trust, where a third-party manager makes investment decisions without their knowledge or input. This can help to eliminate the potential for conflicts of interest, but it’s not a perfect solution.

Stricter Disclosure Requirements

Another approach is to strengthen disclosure requirements, mandating more frequent and detailed reporting of financial transactions. This would make it easier to detect potential insider trading and hold politicians accountable.

Banning Individual Stock Ownership

A more radical solution would be to ban politicians from owning individual stocks altogether, allowing them to invest only in diversified funds like mutual funds or ETFs. This would significantly reduce the risk of conflicts of interest and insider trading.

FAQ: Politicians and Stock Market Investments

Can politicians legally invest in the stock market?

Yes, in most countries, politicians can legally invest in the stock market. However, they are often subject to certain regulations and disclosure requirements.

What is the STOCK Act?

The STOCK Act (Stop Trading on Congressional Knowledge Act) is a U.S. law that prohibits members of Congress and other government employees from using non-public information for personal gain in the stock market.

What are the main concerns about politicians investing in the stock market?

The main concerns are potential conflicts of interest, insider trading, and the erosion of public trust.

What are some potential solutions to address these concerns?

Potential solutions include blind trusts, stricter disclosure requirements, and banning individual stock ownership.

Ultimately, the question of whether politicians should be allowed to invest in the stock market is a matter of balancing individual rights with the need to maintain public trust and prevent corruption. There are valid arguments on both sides of the issue, and the best solution may vary depending on the specific context and legal framework. What is clear is that this is a conversation worth having, and one that demands careful consideration of the ethical implications involved. We need to ensure that our elected officials are acting in the best interests of the public, not their own pocketbooks. The integrity of our democracy depends on it.