Ever wondered how the wealthy seem to grow their fortunes in ways that aren’t readily available to the average investor? A legal private investment company might be part of that equation. These entities, often shrouded in a bit of mystery, offer unique opportunities but also come with their own set of rules and considerations. This article dives into the world of legal private investment companies, exploring what they are, how they operate, and what you need to know before considering one. Let’s demystify this corner of the investment world together.

What is a Legal Private Investment Company?

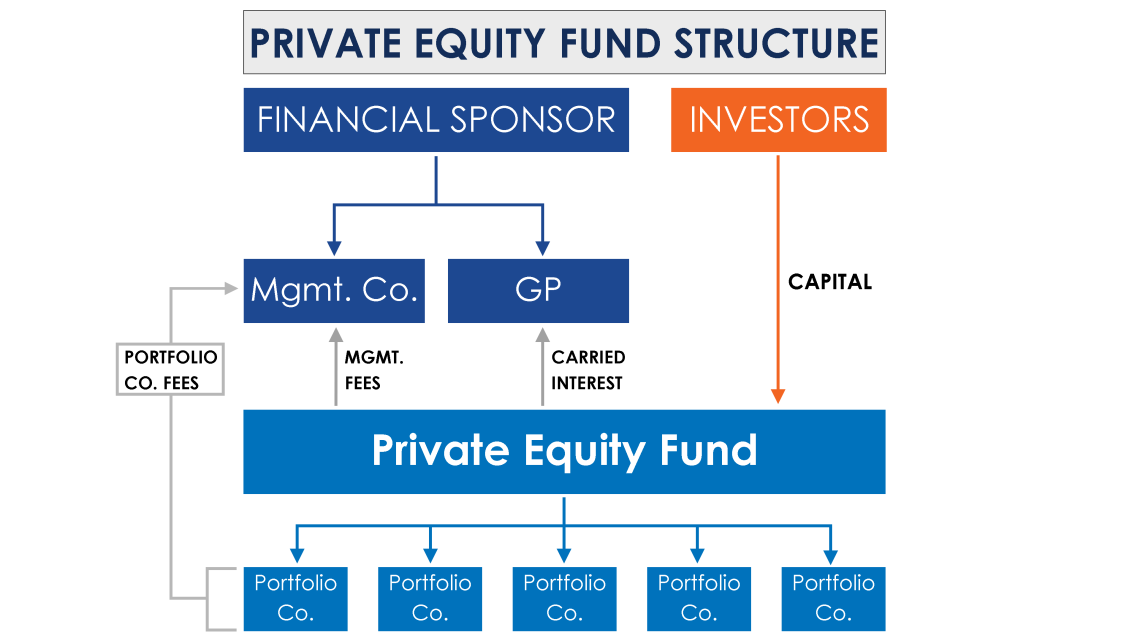

A legal private investment company, at its core, is a business entity formed for the purpose of investing in assets that are not publicly traded. Think of it as a club for accredited investors who pool their resources to access deals unavailable on the stock market. These companies are typically structured as limited partnerships or limited liability companies (LLCs), offering a degree of legal protection to their investors.

Key Characteristics of Legal Private Investment Companies

- Exclusivity: Participation is usually limited to accredited investors, meaning individuals with a high net worth or income.

- Private Offerings: They raise capital through private placements, bypassing the regulatory requirements of public offerings.

- Diverse Investments: They can invest in a wide range of assets, including real estate, private equity, venture capital, and hedge funds.

- Long-Term Focus: Investments are typically illiquid and require a long-term investment horizon.

Tip: Always conduct thorough due diligence before investing in any private investment company. Understand the investment strategy, the management team, and the associated risks.

The Legal Framework Surrounding Private Investment Companies

Navigating the legal landscape is crucial when dealing with private investment companies. These entities operate under specific regulations designed to protect investors, even though they are considered sophisticated. Understanding these regulations is key to ensuring your investment is sound and compliant.

Important Legal Considerations for Legal Private Investment Companies

- Securities Laws: Private placements are subject to securities laws, such as Regulation D in the United States, which provides exemptions from registration for certain offerings.

- Accredited Investor Rules: Companies must verify that investors meet the accredited investor criteria.

- Disclosure Requirements: While not as stringent as for public companies, private investment companies still have disclosure obligations to investors.

- Fiduciary Duty: The managers of the company have a fiduciary duty to act in the best interests of the investors.

Benefits and Risks of Investing in a Legal Private Investment Company

Like any investment, private investment companies offer both potential rewards and inherent risks. Weighing these carefully is essential before committing your capital. Are the potential returns worth the illiquidity and complexity?

Potential Benefits

- Higher Returns: Access to investments with the potential for higher returns than publicly traded assets.

- Diversification: Opportunity to diversify your portfolio beyond traditional stocks and bonds.

- Lower Correlation: Investments may have a lower correlation with the stock market, providing some downside protection;

Potential Risks

- Illiquidity: Investments are typically illiquid, meaning you may not be able to easily sell them.

- Lack of Transparency: Less transparency compared to publicly traded companies.

- Higher Fees: Private investment companies often charge higher fees than traditional investment vehicles.

- Management Risk: The success of the investment depends heavily on the skills and experience of the management team.

Frequently Asked Questions (FAQ)

Investing in a legal private investment company can be a powerful tool for wealth creation, but it’s not without its complexities. It’s crucial to understand the legal framework, the potential benefits and risks, and to conduct thorough due diligence. Remember, this type of investment is generally suitable for sophisticated investors with a long-term perspective. Don’t rush into anything; take your time to research and understand the intricacies involved. Ultimately, informed decisions are the best defense in the world of private investing. Good luck on your investment journey!