Understanding the Allure: Why Should Companies Invest in Junk Bonds?

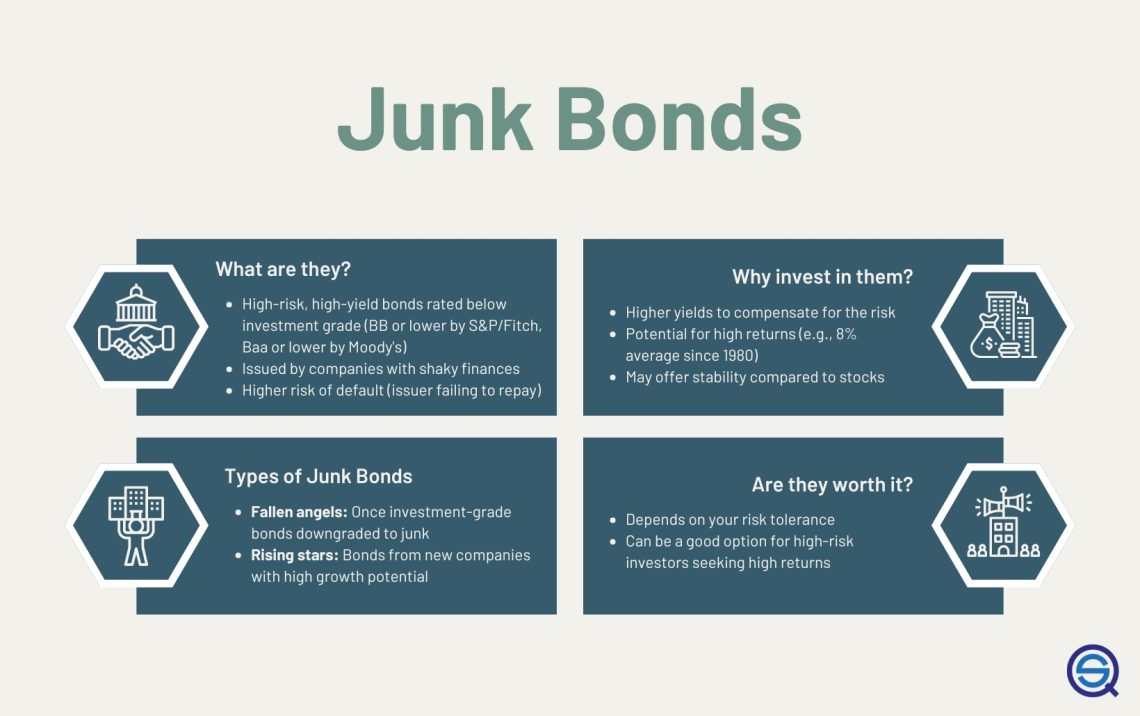

High-yield bonds‚ often referred to as junk bonds‚ are debt instruments issued by companies with lower credit ratings․ These bonds offer higher interest rates compared to investment-grade bonds‚ which can be tempting for companies seeking to boost their investment returns․ The potential for significant gains is a major draw․

However‚ it’s crucial to understand the inherent risks involved․ Investing in junk bonds is not a decision to be taken lightly․ It requires careful consideration of a company’s risk tolerance and investment strategy․

The Risks Involved: A Deep Dive

The primary risk associated with junk bonds is the higher probability of default․ Companies issuing these bonds are often facing financial difficulties or have a less established track record․ This means there’s a greater chance they may not be able to meet their debt obligations․

- Default Risk: The issuer may fail to make timely interest or principal payments․

- Liquidity Risk: Junk bonds can be less liquid than investment-grade bonds‚ making them harder to sell quickly․

- Interest Rate Risk: Junk bond prices are sensitive to changes in interest rates․

When Does It Make Sense? Strategic Considerations

Despite the risks‚ there are situations where investing in junk bonds might be a viable option for companies․ For example‚ if a company has a high risk tolerance and is seeking to generate higher returns‚ a small allocation to junk bonds could be considered․ However‚ this should be done as part of a well-diversified portfolio․

Furthermore‚ a company might consider investing in junk bonds if they have a strong understanding of the market and the ability to conduct thorough due diligence․ Identifying undervalued junk bonds can lead to significant returns․

Alternative Investment Strategies

Before diving into junk bonds‚ companies should explore alternative investment strategies that offer a more balanced risk-reward profile․ These might include:

- Investment-grade corporate bonds

- Government bonds

- Diversified equity portfolios

- Real estate investments

These options generally offer lower returns but also carry significantly less risk․

FAQ: Investing in Junk Bonds

Due Diligence: A Non-Negotiable Imperative

Prior to any allocation of capital towards high-yield debt instruments‚ a comprehensive and rigorous due diligence process is paramount․ This process should encompass a thorough examination of the issuer’s financial standing‚ operational efficiency‚ and competitive landscape․ Furthermore‚ a detailed analysis of the bond indenture‚ including covenants and security provisions‚ is indispensable․

Independent verification of the issuer’s claims and projections is strongly advised․ Engaging external experts‚ such as financial analysts and legal counsel‚ can provide an objective assessment of the risks and potential rewards associated with the investment․

Portfolio Management: Integrating Junk Bonds Strategically

If‚ after careful consideration and due diligence‚ a decision is made to incorporate junk bonds into the investment portfolio‚ it is imperative to do so strategically․ The allocation to high-yield bonds should be commensurate with the company’s risk appetite and investment objectives․ A well-defined investment policy statement should explicitly address the permissible allocation to junk bonds and the criteria for selecting specific issues․

- Diversification: Mitigate risk by investing in a diversified portfolio of junk bonds across different industries and issuers․

- Active Monitoring: Continuously monitor the performance of the portfolio and the creditworthiness of the issuers․

- Rebalancing: Periodically rebalance the portfolio to maintain the desired asset allocation․

Regulatory Compliance: Adhering to Legal Frameworks

Companies must ensure full compliance with all applicable laws and regulations when investing in junk bonds․ This includes adherence to securities laws‚ insider trading regulations‚ and any specific investment guidelines established by regulatory bodies․ Consultation with legal counsel is essential to ensure compliance․

Transparency and disclosure are crucial․ All investment decisions related to junk bonds should be properly documented and disclosed to relevant stakeholders‚ including shareholders and regulatory authorities․

Ethical Considerations: Maintaining Fiduciary Duty

Investment decisions should always be guided by ethical considerations and a commitment to fulfilling fiduciary duties․ Companies have a responsibility to act in the best interests of their shareholders and stakeholders․ This includes making prudent investment decisions that are aligned with the company’s long-term objectives․

Conflicts of interest should be avoided at all costs․ Any potential conflicts of interest related to junk bond investments should be disclosed and managed appropriately․

FAQ: Advanced Considerations

Q: What is the role of credit rating agencies in evaluating junk bonds?

A: Credit rating agencies provide an independent assessment of the creditworthiness of bond issuers․ Their ratings can be a valuable tool for evaluating the risk associated with junk bonds‚ but they should not be the sole basis for investment decisions․

Q: How does macroeconomic environment impact junk bond performance?

A: Economic downturns can significantly increase the risk of default for junk bond issuers‚ leading to lower prices and higher yields․ Conversely‚ periods of economic growth can improve the financial health of issuers and boost junk bond performance․

Q: What are the alternatives to direct investment in junk bonds?

A: Companies can gain exposure to the junk bond market through mutual funds‚ exchange-traded funds (ETFs)‚ or managed accounts․ These options offer diversification and professional management‚ but also come with associated fees․