Understanding the Basics of Investment and Taxes

Investing in companies is a common strategy for wealth building. However, the tax implications can be complex. It’s crucial to understand how different types of investments are treated for tax purposes. This knowledge can significantly impact your overall returns. Let’s delve into the specifics of whether investing in a company is tax deductible.

Direct Investment vs. Indirect Investment

There are two primary ways to invest in a company: direct investment and indirect investment. Direct investment involves purchasing shares directly from the company or in the open market. Indirect investment involves investing through mutual funds, ETFs, or other investment vehicles. The tax implications differ depending on the method.

Tip: Always consult with a qualified tax advisor to understand the specific tax implications of your investment strategy.

Direct Investment Tax Implications

Direct investments typically generate taxable events when you sell the shares. The profit or loss is considered a capital gain or loss. The tax rate on capital gains depends on how long you held the shares. Short-term capital gains (held for one year or less) are taxed at your ordinary income tax rate. Long-term capital gains (held for more than one year) are taxed at a lower rate.

Indirect Investment Tax Implications

Indirect investments, such as mutual funds, pass through capital gains and dividends to investors. These distributions are taxable in the year they are received. The fund itself may also generate capital gains when it sells securities within the portfolio. These gains are then distributed to shareholders.

Is Investing in a Company Tax Deductible? The General Rule

Generally speaking, the act of simply investing in a company is not tax deductible. You cannot deduct the cost of purchasing shares from your taxable income. However, there are some exceptions and nuances to this rule.

Important Note: While the initial investment isn’t deductible, certain losses or expenses related to your investment may be deductible under specific circumstances.

- Capital Losses: If you sell shares for less than you paid for them, you incur a capital loss. You can use capital losses to offset capital gains. If your capital losses exceed your capital gains, you can deduct up to $3,000 of the excess loss from your ordinary income (or $1,500 if married filing separately).

- Worthless Securities: If a security becomes completely worthless, you can deduct the loss as a capital loss. This requires demonstrating that the security has no value.

Exceptions and Special Cases

While the general rule is that investing in a company is not tax deductible, there are some exceptions to consider:

- Small Business Stock (Section 1202): Under Section 1202 of the Internal Revenue Code, you may be able to exclude some or all of the gain from the sale of qualified small business stock (QSBS) held for more than five years. This exclusion is subject to certain limitations and requirements.

- Investment in a Qualified Opportunity Zone (QOZ): Investing in a QOZ through a Qualified Opportunity Fund (QOF) may provide tax benefits, including deferral or elimination of capital gains taxes.

These exceptions are complex and require careful planning and documentation. Consult with a tax professional to determine if you qualify.

FAQ: Tax Deductibility of Company Investments

Q: Can I deduct the cost of buying stock in a company?

A: No, generally you cannot deduct the cost of buying stock. The purchase price is your cost basis, which is used to calculate capital gains or losses when you sell the stock.

Q: What happens if I lose money on my investment?

A: You can deduct capital losses to offset capital gains. If your capital losses exceed your capital gains, you can deduct up to $3,000 of the excess loss from your ordinary income.

Q: Are dividends taxable?

A: Yes, dividends are generally taxable. Qualified dividends are taxed at a lower rate than ordinary income.

Q: What is Section 1202 stock?

A: Section 1202 allows for the exclusion of some or all of the gain from the sale of qualified small business stock held for more than five years, subject to certain limitations.

Record Keeping and Documentation

Meticulous record-keeping is paramount for accurate tax reporting related to investments. Maintain detailed records of all stock purchases, sales, dividend payments, and any other transactions. These records should include the date of the transaction, the number of shares involved, the price per share, and any associated fees or commissions. Proper documentation is essential to substantiate any deductions or credits claimed on your tax return. Failure to maintain adequate records may result in penalties or disallowance of deductions by the relevant tax authorities.

The Role of Professional Advice

The intricacies of investment taxation necessitate the engagement of qualified professionals. A certified public accountant (CPA) or a financial advisor with expertise in tax planning can provide invaluable guidance tailored to your specific financial circumstances. These professionals can assist in navigating complex tax laws, identifying potential deductions or credits, and ensuring compliance with all applicable regulations. Furthermore, they can help you develop a comprehensive investment strategy that minimizes your tax liability while maximizing your long-term returns. Seeking professional advice is a prudent investment that can yield significant benefits in the long run.

Recommendation: Schedule regular consultations with your tax advisor to review your investment portfolio and discuss any potential tax implications of planned transactions.

State and Local Tax Considerations

In addition to federal income taxes, state and local taxes may also apply to investment income and capital gains. The specific rules and rates vary depending on the jurisdiction in which you reside. Some states may have lower tax rates on capital gains than the federal government, while others may have higher rates. It is crucial to understand the state and local tax laws that apply to your investments to ensure accurate tax reporting and compliance. Consult with a tax professional familiar with the tax laws of your state to determine your specific obligations.

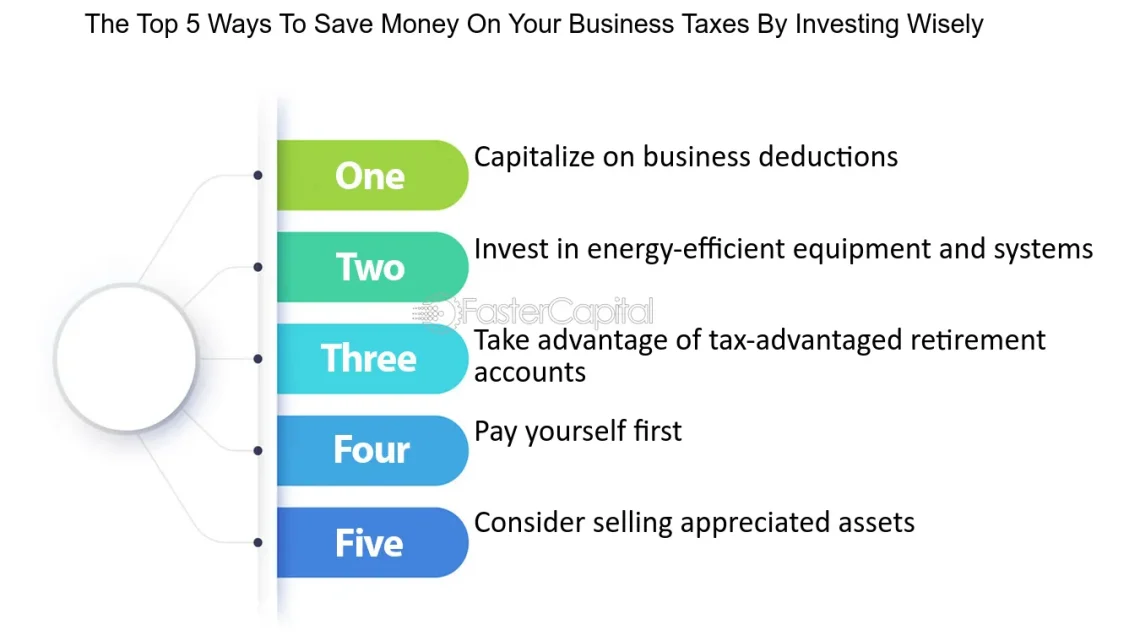

Tax-Advantaged Investment Accounts

Utilizing tax-advantaged investment accounts is a strategic approach to minimizing your tax burden. These accounts, such as 401(k)s, IRAs, and 529 plans, offer various tax benefits, including tax-deferred growth, tax-free withdrawals, or tax-deductible contributions. Contributions to traditional 401(k)s and IRAs may be tax-deductible, reducing your taxable income in the year of contribution. Roth 401(k)s and Roth IRAs offer tax-free withdrawals in retirement, provided certain conditions are met. 529 plans provide tax advantages for education savings. Carefully consider your financial goals and risk tolerance when selecting the appropriate tax-advantaged investment accounts.

While the initial act of investing in a company is tax deductible in limited circumstances, understanding the broader tax implications of your investment activities is essential for effective financial planning. By maintaining meticulous records, seeking professional advice, considering state and local tax laws, and utilizing tax-advantaged investment accounts, you can optimize your investment returns and minimize your tax liability. Remember that tax laws are subject to change, so it is crucial to stay informed and adapt your strategies accordingly. A proactive and informed approach to investment taxation is key to achieving your long-term financial goals.