Ah‚ 2017․ A year of fidget spinners‚ viral challenges‚ and‚ of course‚ the stock market․ Remember the buzz? Everyone was trying to figure out the next big thing‚ the stock that would skyrocket and make them rich․ It’s always fascinating to look back and see which predictions actually came true and which ones completely missed the mark․ So‚ let’s take a trip down memory lane and explore which stocks were hot topics back then and what we can learn from it all․ Were you one of the lucky ones who picked a winner‚ or did you learn a valuable lesson about the unpredictable nature of the market?

Analyzing Potential Stocks for Investment in 2017

Back in 2017‚ the landscape looked quite different․ Several sectors were generating significant buzz‚ each with its own set of promising companies․ Technology‚ as always‚ was a major player‚ but renewable energy and even some more traditional industries were also attracting attention․ The key was identifying companies with strong fundamentals‚ innovative products‚ and a clear path to growth; But‚ let’s be honest‚ that’s easier said than done!

Key Sectors to Watch for Stock Investment in 2017

- Technology: Companies involved in cloud computing‚ artificial intelligence‚ and cybersecurity were highly sought after․

- Renewable Energy: Solar and wind energy companies were gaining momentum due to increasing environmental awareness and government incentives․

- Healthcare: Biotechnology and pharmaceutical companies developing innovative treatments for diseases were considered promising investments․

The Rise of Tech Stocks in 2017: A Prime Investment?

Technology stocks were undoubtedly the darlings of 2017․ Companies like Amazon‚ Apple‚ and Google continued their dominance‚ but smaller‚ more agile tech companies were also making waves․ The question was: could these smaller players sustain their growth and challenge the established giants? Many investors believed they could‚ fueled by the rapid adoption of new technologies and the increasing demand for digital services․

Tip: Remember‚ past performance is not always indicative of future results․ Just because a stock did well in the past doesn’t guarantee it will continue to do so․ Always do your own research!

Identifying Promising Tech Stocks for Investment in 2017

Here are some factors investors considered when evaluating tech stocks in 2017:

- Revenue Growth: Companies with consistently high revenue growth were seen as attractive investments․

- Innovation: Companies developing groundbreaking technologies or disrupting existing markets were highly valued․

- Market Share: Companies with a significant and growing market share were considered to have a competitive advantage․

Beyond Tech: Diversifying Your Stock Investment in 2017

While tech stocks dominated the headlines‚ savvy investors knew the importance of diversification․ Putting all your eggs in one basket‚ no matter how promising that basket may seem‚ is a risky strategy․ Exploring other sectors‚ such as healthcare‚ consumer goods‚ and even real estate‚ could provide a more balanced and resilient portfolio․ Did you diversify your investments back then‚ or did you ride the tech wave?

Exploring Alternative Stock Investment Opportunities in 2017

Consider these sectors for diversification:

- Healthcare: The aging population and increasing demand for healthcare services made this sector a potentially stable investment․

- Consumer Goods: Companies selling essential consumer goods often provide a steady stream of revenue‚ even during economic downturns․

Interesting Fact: Diversification doesn’t guarantee profits or prevent losses‚ but it can help reduce the overall risk of your portfolio․

Learning from 2017: Key Takeaways for Future Stock Investments

Looking back at 2017‚ what lessons can we learn? The stock market is a complex and ever-changing beast․ Predictions are often wrong‚ and even the most promising companies can face unexpected challenges․ The key is to stay informed‚ do your research‚ and be prepared to adapt to changing market conditions․ And‚ perhaps most importantly‚ don’t let emotions cloud your judgment․

Important Considerations for Stock Investment Decisions

- Do your own research: Don’t rely solely on the advice of others․

- Understand your risk tolerance: Invest in stocks that align with your comfort level․

- Stay informed: Keep up-to-date with market news and trends․

FAQ: Investing in Stocks — Then and Now

What were some popular investment strategies in 2017?

Growth investing‚ value investing‚ and dividend investing were all popular strategies․ Growth investors sought companies with high growth potential‚ while value investors looked for undervalued stocks․ Dividend investors focused on companies that paid regular dividends․

How did interest rates affect stock investments in 2017?

Interest rates were relatively low in 2017‚ which generally supported stock prices․ Low interest rates make borrowing cheaper for companies‚ which can fuel growth․

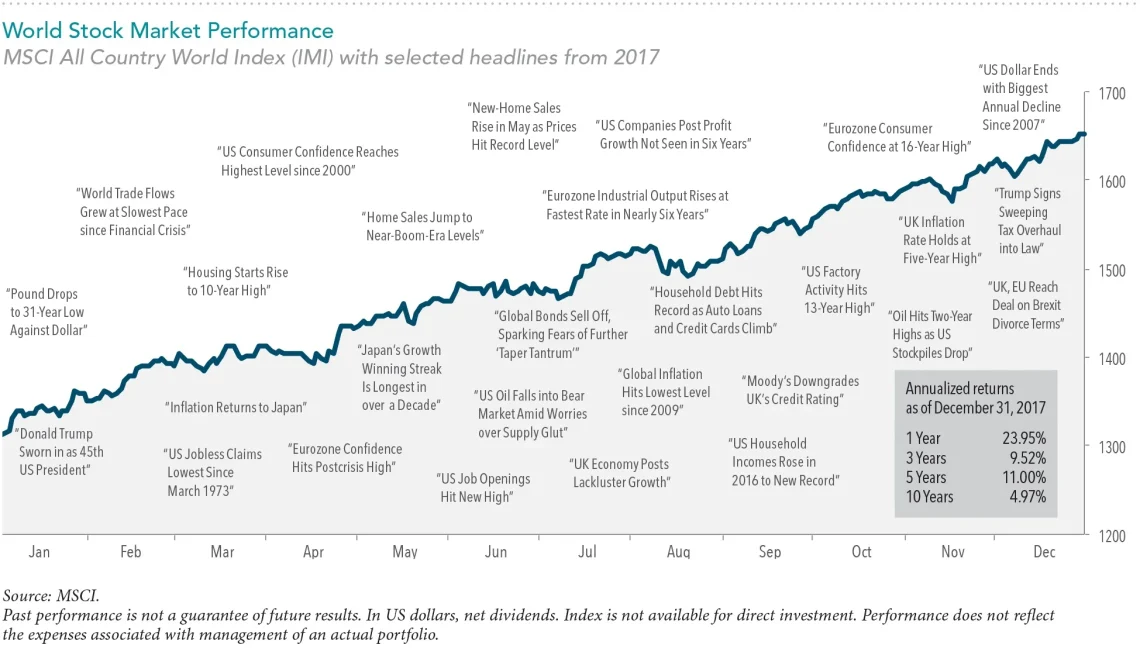

What role did global events play in the stock market in 2017?

Global events‚ such as political developments and economic trends‚ had a significant impact on the stock market․ Investors closely monitored these events to assess potential risks and opportunities․

So‚ as we reflect on the stock market of 2017‚ it’s clear that predicting the future is a difficult‚ if not impossible‚ task․ The best approach is to focus on building a well-diversified portfolio based on sound research and a clear understanding of your own investment goals․ Remember that patience and discipline are key virtues in the world of investing․ Hopefully‚ this trip down memory lane has provided some valuable insights․ Now‚ let’s look forward to the future and apply these lessons to our investment decisions today․