The gold standard, a monetary system where a country’s currency is directly linked to a fixed quantity of gold, evokes images of stability and fiscal responsibility․ But does this shimmering allure truly translate into a golden age for investment? While the idea of a currency backed by something tangible might sound reassuring, the reality is that the gold standard can actually put a damper on investment․ Think about it: tying your economy’s hands to a single commodity can create some serious limitations․ Let’s dive into why the gold standard might not be the investment paradise it appears to be․

How the Gold Standard Discourages Investment: A Closer Look

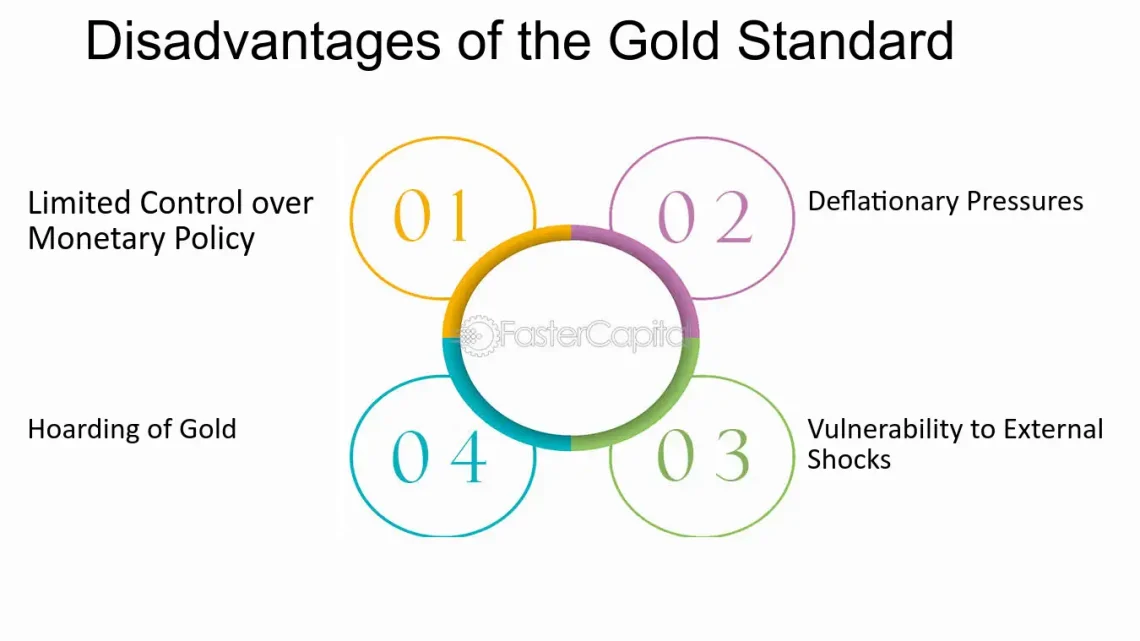

The gold standard, while seemingly offering stability, can inadvertently discourage investment through several key mechanisms․ It’s not always about what glitters, but what actually allows for growth and flexibility in the economy․ Let’s explore these mechanisms․

Limited Monetary Policy Flexibility and Investment

One of the biggest drawbacks of the gold standard is its rigid control over monetary policy․ Central banks are essentially handcuffed, unable to freely adjust interest rates or the money supply to respond to economic fluctuations․ Imagine a recession hitting․ Usually, a central bank would lower interest rates to encourage borrowing and investment․ Under the gold standard, this becomes difficult, if not impossible, if it jeopardizes the fixed gold parity․ This lack of flexibility can stifle investment during downturns․

Tip: Think of the gold standard as a beautiful, but inflexible, golden cage․ It might look impressive, but it limits your freedom to maneuver․

Deflationary Pressures and Investment Hesitation

Because the money supply is tied to the available gold reserves, the gold standard often leads to deflationary pressures․ As the economy grows, the amount of gold might not keep pace, leading to falling prices․ While lower prices might sound good on the surface, deflation can actually discourage investment․ Why? Because investors might delay projects, anticipating even lower costs in the future․ This “wait-and-see” approach can paralyze economic activity and hinder long-term investment․

- Deflation increases the real value of debt, making it harder for businesses to repay loans․

- Consumers postpone purchases, expecting prices to fall further․

- Businesses reduce investment, fearing lower profits in the future․

Exchange Rate Rigidity and Investment Uncertainty

The gold standard aims to fix exchange rates between countries․ While this can reduce currency risk, it also eliminates a crucial mechanism for adjusting to economic shocks; If a country’s economy is struggling, a floating exchange rate would typically depreciate, making its exports more competitive and attracting foreign investment․ Under the gold standard, this adjustment is blocked․ This rigidity can create imbalances and discourage investment in sectors that are negatively affected by the fixed exchange rate․