What is Forex?

The foreign exchange market, often shortened to Forex or FX, is a global decentralized marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. Understanding the basics is crucial for anyone looking to participate.

Unlike stock exchanges, Forex doesn’t have a central physical location. Instead, it operates electronically, 24 hours a day, five days a week. This continuous trading is possible because the market is spread across different time zones globally.

Tip: Forex trading involves significant risk. Always start with a demo account to practice and understand the market dynamics before risking real capital;

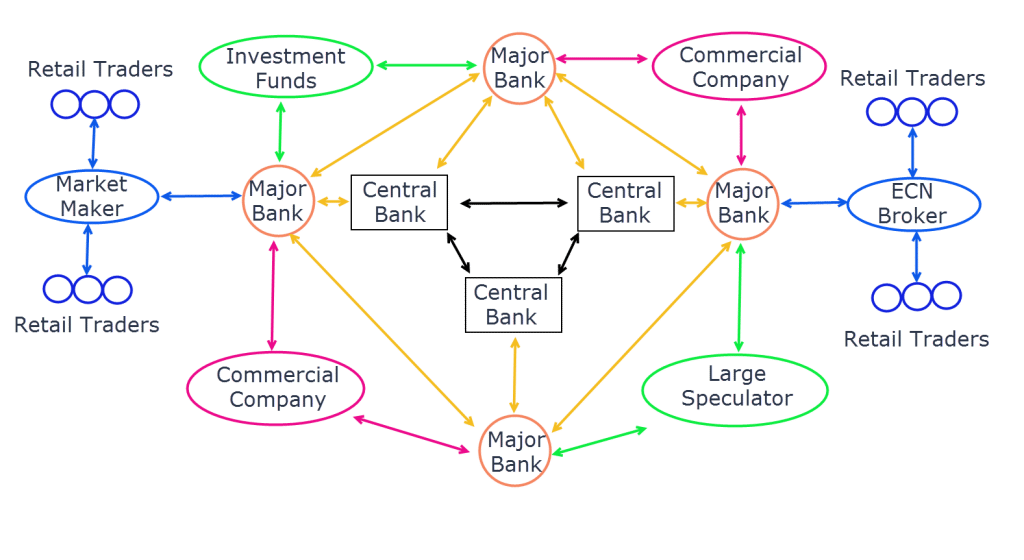

Key Players in the Forex Market

The Forex market is a diverse ecosystem with various participants, each playing a unique role. These players influence currency values and market dynamics.

- Central Banks: These institutions manage their country’s currency, interest rates, and monetary policy. Their actions can significantly impact currency values.

- Commercial Banks: Major banks facilitate Forex transactions for their clients and also trade on their own accounts.

- Hedge Funds and Investment Firms: These entities trade currencies to generate profits, often using sophisticated strategies.

- Corporations: Businesses involved in international trade need to exchange currencies to pay for goods and services.

- Retail Traders: Individual investors who trade currencies through online brokers.

Each participant has different motivations and trading strategies, contributing to the market’s complexity and volatility.

Understanding Currency Pairs

In Forex, currencies are always traded in pairs. You are essentially buying one currency and selling another simultaneously. The first currency in the pair is called the base currency, and the second is the quote currency.

For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. The price of the pair indicates how many US dollars (USD) are needed to buy one Euro (EUR).

Major Currency Pairs

These are the most frequently traded currency pairs and typically have the tightest spreads (the difference between the buying and selling price):

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

Quote: “The key to successful Forex trading is understanding the economic factors that influence currency values and developing a disciplined trading strategy.” ― A Forex Trading Expert

Factors Influencing Forex Rates

Numerous factors can influence Forex rates, making it a dynamic and sometimes unpredictable market. Staying informed about these factors is crucial for making informed trading decisions.

- Economic Indicators: Data releases such as GDP, inflation rates, unemployment figures, and manufacturing indices can significantly impact currency values.

- Interest Rates: Central bank interest rate decisions are a major driver of currency values. Higher interest rates tend to attract foreign investment, increasing demand for the currency.

- Political Stability: Political events, such as elections, policy changes, and geopolitical tensions, can create volatility in the Forex market.

- Market Sentiment: Overall market sentiment, driven by news and events, can also influence currency values.

It’s important to analyze these factors in conjunction to get a comprehensive view of the market;

FAQ: How Does the Forex Market Works? Q: Is Forex trading gambling?

A: While Forex trading involves risk, it’s not gambling if approached with a well-defined strategy, risk management techniques, and a thorough understanding of the market. Gambling relies on chance, while successful Forex trading relies on analysis and skill.

Q: What is leverage in Forex trading?

A: Leverage allows you to control a larger position with a smaller amount of capital. While it can amplify profits, it can also amplify losses. It’s crucial to use leverage responsibly.

Q: How do Forex brokers make money?

A: Forex brokers typically make money through the spread (the difference between the buying and selling price) or by charging commissions on trades.

Q: What is a pip?

A: A pip (percentage in point) is the smallest unit of price movement in a currency pair. It’s typically the fourth decimal place (e.g., 0.0001) for most currency pairs.

The foreign exchange market, often shortened to Forex or FX, is a global decentralized marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. Understanding the basics is crucial for anyone looking to participate.

Unlike stock exchanges, Forex doesn’t have a central physical location. Instead, it operates electronically, 24 hours a day, five days a week. This continuous trading is possible because the market is spread across different time zones globally.

Tip: Forex trading involves significant risk. Always start with a demo account to practice and understand the market dynamics before risking real capital.

The Forex market is a diverse ecosystem with various participants, each playing a unique role. These players influence currency values and market dynamics.

- Central Banks: These institutions manage their country’s currency, interest rates, and monetary policy. Their actions can significantly impact currency values.

- Commercial Banks: Major banks facilitate Forex transactions for their clients and also trade on their own accounts.

- Hedge Funds and Investment Firms: These entities trade currencies to generate profits, often using sophisticated strategies.

- Corporations: Businesses involved in international trade need to exchange currencies to pay for goods and services.

- Retail Traders: Individual investors who trade currencies through online brokers.

Each participant has different motivations and trading strategies, contributing to the market’s complexity and volatility.

In Forex, currencies are always traded in pairs. You are essentially buying one currency and selling another simultaneously. The first currency in the pair is called the base currency, and the second is the quote currency.

For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. The price of the pair indicates how many US dollars (USD) are needed to buy one Euro (EUR).

These are the most frequently traded currency pairs and typically have the tightest spreads (the difference between the buying and selling price):

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

- USD/CAD (US Dollar/Canadian Dollar)

Quote: “The key to successful Forex trading is understanding the economic factors that influence currency values and developing a disciplined trading strategy.” ― A Forex Trading Expert

Numerous factors can influence Forex rates, making it a dynamic and sometimes unpredictable market. Staying informed about these factors is crucial for making informed trading decisions.

- Economic Indicators: Data releases such as GDP, inflation rates, unemployment figures, and manufacturing indices can significantly impact currency values.

- Interest Rates: Central bank interest rate decisions are a major driver of currency values. Higher interest rates tend to attract foreign investment, increasing demand for the currency.

- Political Stability: Political events, such as elections, policy changes, and geopolitical tensions, can create volatility in the Forex market.

- Market Sentiment: Overall market sentiment, driven by news and events, can also influence currency values.

It’s important to analyze these factors in conjunction to get a comprehensive view of the market.

A: While Forex trading involves risk, it’s not gambling if approached with a well-defined strategy, risk management techniques, and a thorough understanding of the market. Gambling relies on chance, while successful Forex trading relies on analysis and skill.

A: Leverage allows you to control a larger position with a smaller amount of capital. While it can amplify profits, it can also amplify losses. It’s crucial to use leverage responsibly.

A: Forex brokers typically make money through the spread (the difference between the buying and selling price) or by charging commissions on trades.

A: A pip (percentage in point) is the smallest unit of price movement in a currency pair. It’s typically the fourth decimal place (e.g., 0.0001) for most currency pairs.