Buying a car is a big decision, and understanding the financial aspects is crucial. One of the most important factors to consider is the interest rate on your car loan. Interest rates can fluctuate significantly, impacting your monthly payments and the total cost of the vehicle. So, the burning question is: have car loan interest rates dropped recently? Let’s dive into the current auto loan landscape and explore what’s influencing these rates.

Understanding Current Car Loan Interest Rates

So, are car loan interest rates actually dropping? Well, it’s complicated. Many factors influence these rates, and it’s not always a straightforward “yes” or “no” answer. Let’s break down what’s happening.

Factors Influencing Car Loan Interest Rates

Several key elements play a role in determining the interest rate you’ll receive on a car loan. These include:

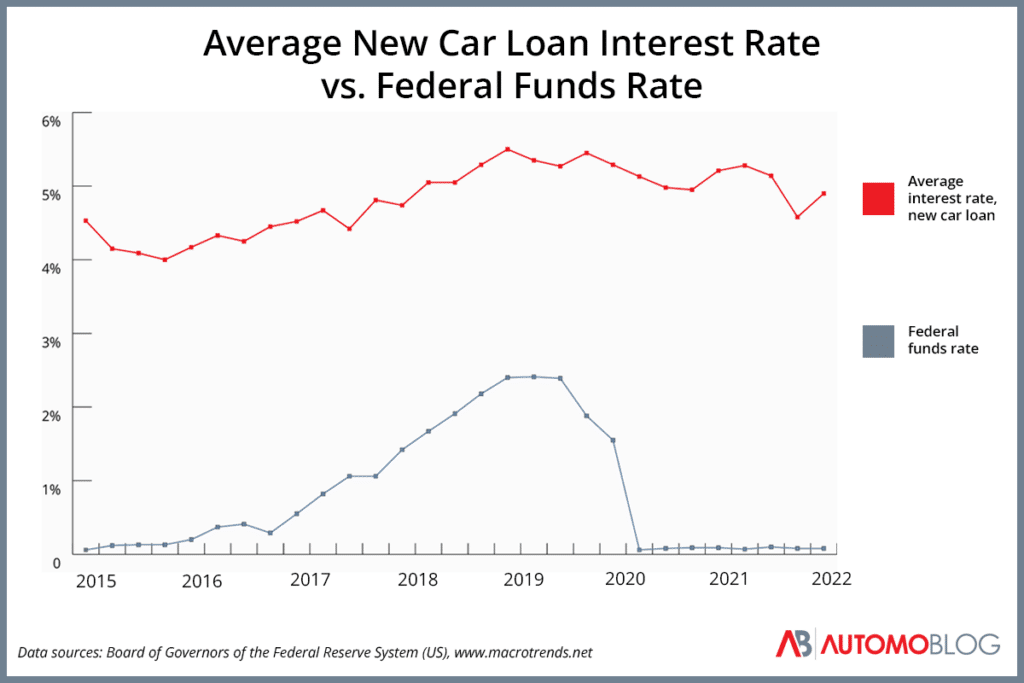

- Federal Reserve Policies: The Fed’s decisions on benchmark interest rates have a ripple effect on all types of loans, including auto loans.

- Economic Conditions: A strong economy often leads to higher interest rates, while a weaker economy may result in lower rates.

- Your Credit Score: This is a big one! A higher credit score typically qualifies you for a lower interest rate.

- Loan Term: Shorter loan terms often come with lower interest rates, but higher monthly payments.

- Type of Vehicle: New cars often have lower interest rates compared to used cars.

Tip: Before you start car shopping, check your credit score! Knowing your creditworthiness will give you a better idea of the interest rates you can expect.

Analyzing Recent Trends in Car Loan Interest Rates

Keeping an eye on recent trends is essential. Have we seen a consistent decline, or are rates fluctuating? Let’s examine the data.

Comparing Car Loan Interest Rates Over Time

Looking at historical data can provide valuable insights. For example, comparing rates from the past year to the present can reveal whether there’s a downward trend or if rates have plateaued. Remember, past performance isn’t a guarantee of future results, but it can offer context.

Are you feeling overwhelmed yet? Don’t worry; it’s all about staying informed and making smart decisions.

How to Get the Best Car Loan Interest Rate

Okay, so what can you do to secure the best possible interest rate on your car loan? Here are some actionable steps:

Tips for Securing Lower Car Loan Interest Rates

- Improve Your Credit Score: Pay your bills on time, reduce your debt, and avoid opening too many new credit accounts.

- Shop Around: Don’t settle for the first offer you receive. Get quotes from multiple lenders, including banks, credit unions, and online lenders.

- Consider a Shorter Loan Term: If you can afford the higher monthly payments, a shorter loan term can save you money on interest in the long run.

- Make a Larger Down Payment: A larger down payment reduces the amount you need to borrow, which can result in a lower interest rate.

- Get Pre-Approved: Getting pre-approved for a car loan gives you negotiating power and helps you understand your budget.

Interesting Fact: Did you know that credit unions often offer lower interest rates on car loans compared to traditional banks? It’s worth checking them out!

The Impact of Car Loan Interest Rates on Your Budget

Understanding how interest rates affect your budget is crucial for making informed decisions. Let’s explore the financial implications.

Calculating the Total Cost of Your Car Loan

It’s not just about the monthly payment; it’s about the total cost of the loan, including interest. Use an online car loan calculator to see how different interest rates and loan terms impact the total amount you’ll pay over the life of the loan. It can be eye-opening!

Think of it this way: a seemingly small difference in interest rates can add up to hundreds or even thousands of dollars over the course of a loan. That’s money you could be using for other things!

Frequently Asked Questions (FAQ)

Q: How does my credit score affect my car loan interest rate?

So, have car loan interest rates dropped? The answer isn’t always simple, but by understanding the factors that influence these rates and taking proactive steps to improve your financial situation, you can secure the best possible deal. Remember to shop around, compare offers, and stay informed. Buying a car is a significant investment, and taking the time to do your research will pay off in the long run. Don’t rush the process; take your time and make a smart, informed decision. Ultimately, the best car loan is the one that fits your budget and helps you achieve your financial goals. Good luck with your car-buying journey!