The Allure of Gold Coins

Gold coins have captivated collectors and investors for centuries. Their intrinsic value, historical significance, and aesthetic appeal make them a unique asset class. But is collecting gold coins a good investment? The answer, as with most investments, is nuanced and depends on several factors.

Factors Influencing Gold Coin Value

Several elements contribute to the value of gold coins beyond their gold content. Understanding these factors is crucial for making informed investment decisions.

- Gold Content: The weight and purity of the gold are fundamental.

- Rarity: Limited mintage coins command higher premiums.

- Condition: A coin’s state of preservation significantly impacts its value. Look for coins with minimal wear and original luster.

- Historical Significance: Coins associated with important historical events or figures are often highly sought after.

- Demand: Market demand from collectors and investors plays a vital role.

Tip: Always research the specific coin you’re interested in. Consult reputable numismatic experts and price guides to assess its true value.

Potential Benefits of Investing in Gold Coins

Investing in gold coins offers several potential advantages:

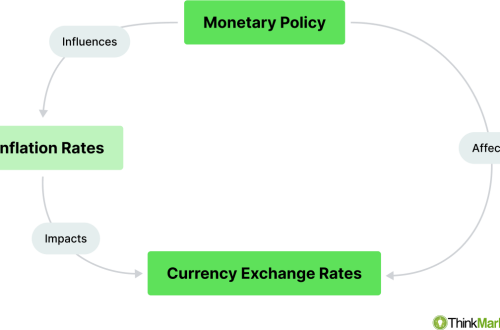

- Hedge Against Inflation: Gold often maintains its value during periods of inflation.

- Portfolio Diversification: Gold coins can diversify your investment portfolio, reducing overall risk.

- Tangible Asset: Unlike stocks or bonds, gold coins are a physical asset you can hold.

- Potential for Appreciation: Rare and well-preserved coins can appreciate significantly in value over time.

Remember, past performance is not indicative of future results. While gold has historically been a safe haven asset, its value can fluctuate.

Risks to Consider

While gold coins offer potential benefits, it’s essential to be aware of the risks involved:

- Market Volatility: The price of gold can fluctuate significantly.

- Counterfeiting: Fake coins are a concern. Always purchase from reputable dealers.

- Storage Costs: Secure storage may incur additional expenses.

- Liquidity: Selling gold coins may take time and effort.

- Dealer Markups: Dealers typically charge a premium over the spot price of gold.

Important: Never buy gold coins from unverified sources. Always authenticate coins before making a purchase.

Frequently Asked Questions (FAQ)

Q: What types of gold coins are best for investment?

A: Popular choices include American Eagles, Canadian Maple Leafs, South African Krugerrands, and pre-1933 US gold coins. Research the specific coins and their historical performance.

Q: Where can I buy gold coins?

A: Reputable coin dealers, online marketplaces (with caution), and auction houses are common sources. Always verify the seller’s credentials.

Q: How do I store my gold coins safely?

A: Options include bank safe deposit boxes, home safes, and professional storage facilities. Consider insurance to protect against theft or damage.

Q: How do I authenticate a gold coin?

A: Consult a professional numismatist or use reputable grading services like PCGS or NGC.

Q: What percentage of my portfolio should be in gold coins?

A: Financial advisors typically recommend allocating a small percentage (e.g., 5-10%) of your portfolio to precious metals like gold;

Developing a Gold Coin Investment Strategy

A coherent investment strategy is paramount to achieving success in the gold coin market. This strategy should be predicated upon a thorough understanding of one’s financial objectives, risk tolerance, and investment horizon; Diversification within the gold coin market itself is also advisable. Consider allocating capital across various coin types, grades, and historical periods to mitigate risk and capitalize on diverse market opportunities.

- Define Investment Goals: Are you seeking long-term capital appreciation, inflation hedging, or portfolio diversification?

- Assess Risk Tolerance: Determine the level of price volatility you are comfortable with.

- Establish a Budget: Allocate a specific amount of capital for gold coin investments.

- Conduct Due Diligence: Thoroughly research potential acquisitions before committing capital.

The Importance of Numismatic Expertise

Navigating the complexities of the gold coin market necessitates a degree of numismatic expertise. While self-education is valuable, consulting with seasoned numismatists can provide invaluable insights and guidance. These professionals possess the knowledge and experience to accurately assess coin values, identify potential pitfalls, and negotiate favorable transaction terms. Furthermore, they can assist in building a well-rounded and strategically aligned gold coin collection.

Recommendation: Seek guidance from a certified numismatist before making significant gold coin investments. Their expertise can significantly enhance your investment outcomes.

Tax Implications of Gold Coin Investments

The acquisition and disposition of gold coins are subject to various tax regulations. It is imperative to consult with a qualified tax advisor to understand the specific tax implications applicable to your individual circumstances. Capital gains taxes may apply to profits realized from the sale of gold coins, and the tax treatment may vary depending on the holding period and the nature of the investment (e.g., personal collection versus business inventory). Proper record-keeping is essential for accurate tax reporting.

Long-Term Perspective and Patience

Investing in gold coins is generally considered a long-term endeavor. While short-term price fluctuations are inevitable, the true potential of gold coin investments lies in their ability to appreciate over extended periods. Patience and a disciplined approach are crucial for weathering market volatility and realizing long-term capital gains. Avoid impulsive buying or selling decisions based on short-term market trends. Instead, focus on the fundamental value of the coins and their potential for future appreciation.