Understanding the Forex Market

The Forex market‚ or foreign exchange market‚ is a decentralized global marketplace where currencies are traded; It’s the largest and most liquid financial market in the world‚ with trillions of dollars changing hands daily․ Understanding its dynamics is crucial before you even consider how to start a forex exchange business․ It operates 24 hours a day‚ five days a week‚ offering opportunities for profit around the clock․ However‚ it’s also highly volatile and requires a solid understanding of economic indicators‚ geopolitical events‚ and technical analysis․

Tip: Start with a demo account to practice trading strategies and familiarize yourself with the Forex market without risking real capital․ This is an invaluable step in your journey․

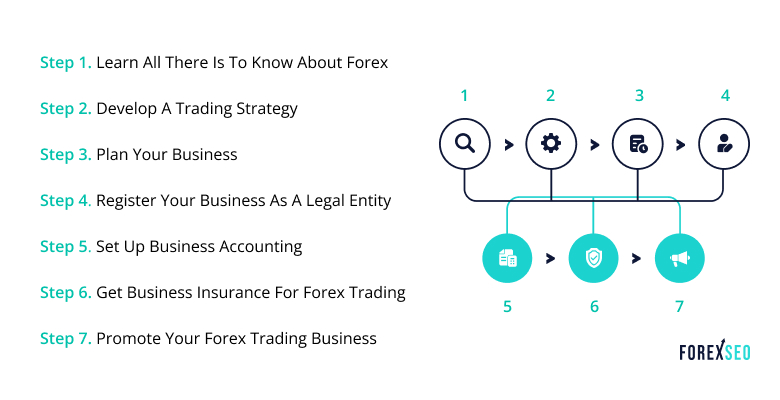

Developing a Business Plan

A comprehensive business plan is essential for any successful venture‚ and starting a Forex exchange business is no exception․ This plan should outline your business goals‚ target market‚ competitive analysis‚ marketing strategy‚ and financial projections․ It’s your roadmap to success․ Consider these key elements:

- Executive Summary: A brief overview of your business․

- Company Description: Details about your company’s structure and mission․

- Market Analysis: Research on your target audience and competitors․

- Service Offering: What specific Forex services will you provide?

- Marketing and Sales Strategy: How will you attract and retain clients?

- Financial Projections: Revenue forecasts‚ expense budgets‚ and profitability analysis․

- Management Team: Who are the key personnel and what are their qualifications?

Legal and Regulatory Requirements

The Forex industry is heavily regulated‚ and compliance is paramount․ Before you officially how to start a forex exchange business‚ you must understand and adhere to all applicable laws and regulations in your jurisdiction․ This often involves obtaining licenses from regulatory bodies such as the Financial Conduct Authority (FCA) in the UK‚ the Securities and Exchange Commission (SEC) in the US‚ or similar organizations in other countries․ Failure to comply can result in hefty fines‚ legal action‚ and even closure of your business․

Important: Consult with legal and financial professionals to ensure you meet all regulatory requirements and avoid potential pitfalls․

Setting Up Your Infrastructure

Your infrastructure is the backbone of your Forex exchange business․ This includes:

- Trading Platform: Choose a reliable and user-friendly trading platform for your clients․

- Payment Processing System: Integrate secure payment gateways for deposits and withdrawals․

- Risk Management System: Implement robust risk management tools to protect your business and clients․

- Customer Support System: Provide excellent customer service to build trust and loyalty․

- IT Infrastructure: Ensure you have a secure and reliable IT infrastructure to support your operations․

Investing in high-quality technology and security measures is crucial for building a reputable and trustworthy Forex exchange business․

Marketing and Client Acquisition

Attracting and retaining clients is essential for the success of your Forex exchange business․ Develop a comprehensive marketing strategy that includes:

- Online Marketing: Utilize SEO‚ social media marketing‚ and paid advertising to reach your target audience․

- Content Marketing: Create valuable content such as blog posts‚ articles‚ and webinars to educate and engage potential clients․

- Partnerships: Collaborate with other businesses in the financial industry to expand your reach․

- Referral Programs: Incentivize existing clients to refer new clients to your business․

Building a strong brand reputation and providing excellent customer service are key to long-term success․