Feeling overwhelmed by debt? You’re definitely not alone. Many people find themselves juggling multiple bills, each with its own interest rate and due date. It’s a stressful situation, and the thought of simplifying things is incredibly appealing. Debt consolidation loans are often touted as a potential solution, but the big question remains: does debt consolidation actually help your credit score, or is it just another financial band-aid? Let’s dive into the nitty-gritty and see what’s what.

Understanding Debt Consolidation Loans and Your Credit

So, what exactly is a debt consolidation loan? Simply put, it’s a new loan you take out to pay off all your existing debts. Instead of making multiple payments to different creditors, you make a single payment to the lender providing the consolidation loan. Sounds good, right? But how does this affect your credit?

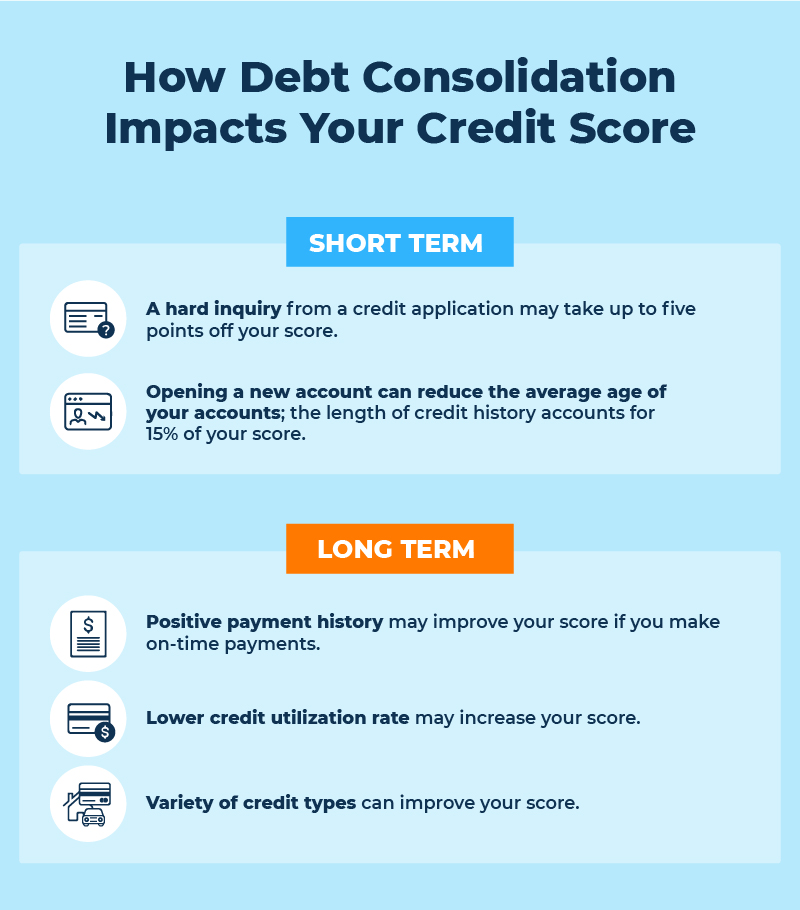

The impact on your credit score isn’t always straightforward. It depends on several factors, including your credit history, the terms of the loan, and how you manage your finances after consolidation.

How Debt Consolidation Loans Can Potentially Help Your Credit

Believe it or not, debt consolidation can sometimes give your credit score a boost. Here’s how:

Lowering Your Credit Utilization Ratio with Debt Consolidation

Your credit utilization ratio (the amount of credit you’re using compared to your total available credit) is a major factor in your credit score. A lower ratio is better. If your debt consolidation loan allows you to pay off high-interest credit card debt, it can lower your credit utilization, potentially improving your score. For example:

- Say you have three credit cards, each with a $5,000 limit, and you’re maxed out on all of them.

- That’s $15,000 in debt and a 100% utilization ratio. Ouch!

- A debt consolidation loan can pay off those cards, leaving them with a zero balance and significantly lowering your utilization.

Simplifying Payments and Avoiding Late Fees with Debt Consolidation

Missing payments is a huge no-no when it comes to credit scores. A debt consolidation loan simplifies your finances by turning multiple payments into one. This can make it easier to stay on top of your bills and avoid late fees, which can negatively impact your credit score. Are you constantly forgetting due dates? This could be a lifesaver!

Tip: Set up automatic payments for your debt consolidation loan to ensure you never miss a due date. This is a simple way to protect your credit score.

Potentially Lowering Interest Rates with Debt Consolidation

If you can secure a debt consolidation loan with a lower interest rate than your existing debts, you’ll save money on interest payments in the long run. While this doesn’t directly improve your credit score, it frees up cash that can be used to pay down the principal faster, which can indirectly help your credit.

How Debt Consolidation Loans Can Potentially Hurt Your Credit

It’s not all sunshine and roses. Debt consolidation can also negatively impact your credit if you’re not careful. Here’s what to watch out for:

Taking on More Debt with Debt Consolidation

If you use the debt consolidation loan as an excuse to rack up more debt on your credit cards, you’ll end up in a worse situation than you started. It’s crucial to avoid this temptation. Willpower is key!

Closing Credit Card Accounts After Debt Consolidation

Closing credit card accounts after paying them off with a debt consolidation loan can actually hurt your credit score. Why? Because it reduces your overall available credit, potentially increasing your credit utilization ratio on your remaining cards. Think twice before closing those accounts!

- Instead of closing them, consider keeping them open and using them responsibly for small purchases that you pay off in full each month.

- This helps build a positive credit history and maintains a healthy credit utilization ratio.

Hard Inquiries and Initial Credit Score Dip with Debt Consolidation

Applying for a debt consolidation loan will result in a “hard inquiry” on your credit report, which can temporarily lower your credit score. The impact is usually small and short-lived, but it’s something to be aware of. Are you planning on applying for a mortgage soon? Maybe hold off on the debt consolidation.

Important Note: Always shop around for the best interest rate and terms on a debt consolidation loan. Don’t settle for the first offer you receive.

Alternatives to Debt Consolidation Loans for Credit Improvement

Debt consolidation loans aren’t the only way to improve your credit. Here are a few other options to consider:

Balance Transfer Credit Cards

If you have good credit, you might qualify for a balance transfer credit card with a 0% introductory APR. This allows you to transfer your high-interest debt to the new card and pay it off interest-free for a limited time. It’s a great option if you’re disciplined and can pay off the balance before the introductory period ends.

Debt Management Plans (DMPs)

DMPs are offered by credit counseling agencies. They work with your creditors to lower your interest rates and create a manageable repayment plan. This can be a good option if you’re struggling to manage your debt on your own.

Negotiating with Creditors

Sometimes, you can negotiate directly with your creditors to lower your interest rates or create a payment plan. It’s worth a try, especially if you’re facing financial hardship.

Frequently Asked Questions About Debt Consolidation and Credit

So, does debt consolidation help credit? The answer, as you can see, is a resounding “it depends.” It’s not a magic bullet, and it’s not without its risks. It’s a tool, and like any tool, it can be used effectively or ineffectively. The key is to understand the potential benefits and drawbacks, and to make sure you’re using it responsibly. Ultimately, the best way to improve your credit is to practice good financial habits: pay your bills on time, keep your credit utilization low, and avoid taking on more debt than you can handle. Good luck on your journey to financial freedom!