Ever wondered where your retirement money goes when you contribute to a public pension? It’s a complex world of investment strategies, and a significant portion often finds its way into the stock market. Public pension funds, responsible for securing the retirement of millions of teachers, firefighters, and other public servants, face the daunting task of generating substantial returns to meet their future obligations. So, do they invest in stocks? The short answer is a resounding yes, but the how and why are far more interesting. Let’s dive into the details and explore the role of stocks in public pension portfolios.

Why Public Pensions Invest in Stocks

Public pension funds invest in a variety of assets to grow their funds and meet future payout obligations. But why stocks? Well, stocks historically offer higher returns compared to other asset classes like bonds or cash. This potential for growth is crucial for pension funds to meet their long-term liabilities. Think of it like planting a seed – you need it to grow into a strong tree to provide shade for years to come. Stocks are often seen as that seed with the greatest potential for long-term growth.

The Need for Higher Returns

Pension funds face a significant challenge: they need to generate enough returns to cover the retirement benefits promised to their members. With increasing life expectancies and often underfunded pension systems, the pressure to achieve high returns is immense. Investing in stocks is often seen as a necessary strategy to bridge this gap.

Diversification Benefits of Stocks

Stocks also offer diversification benefits. By including stocks in their portfolios, pension funds can reduce overall portfolio risk. Different asset classes react differently to market conditions, so a mix of assets can help cushion the impact of any single investment performing poorly. It’s like having a safety net – you’re protected if one part fails.

How Public Pensions Allocate Investments: The Role of Stocks

The allocation of investments in a public pension fund is a carefully considered process, balancing risk and return. While the exact percentage varies depending on the fund’s specific circumstances and risk tolerance, stocks typically represent a significant portion of the portfolio.

Typical Asset Allocation Strategies

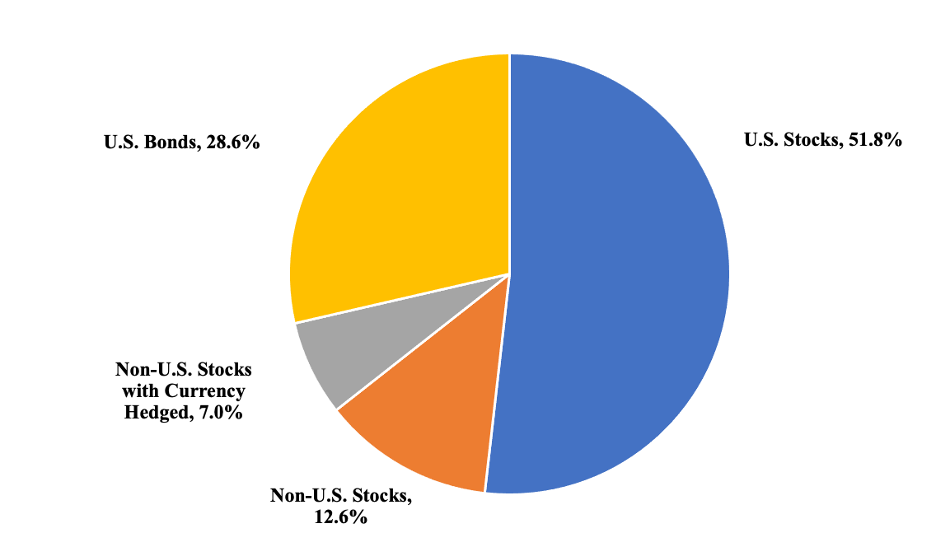

A typical public pension fund might allocate its assets as follows:

- Stocks: 40-60%

- Bonds: 20-40%

- Real Estate: 5-15%

- Alternative Investments (Private Equity, Hedge Funds): 5-15%

As you can see, stocks often make up the largest single allocation. This reflects the fund’s need for growth and its willingness to accept a certain level of risk to achieve that growth.

Factors Influencing Stock Allocation

Several factors influence the specific allocation to stocks, including:

- The fund’s funding level: Underfunded funds may need to take on more risk to catch up.

- The age of the workforce: Funds with younger workers have a longer time horizon and can afford to invest more aggressively.

- Market conditions: Funds may adjust their allocation based on their outlook for the stock market.

Risks and Rewards of Public Pensions Investing in Stocks

Investing in stocks is not without its risks. The stock market can be volatile, and there’s always the potential for losses. However, the potential rewards can be substantial, and for pension funds with long-term horizons, the benefits often outweigh the risks.

Potential Risks of Stock Investments

The primary risk is, of course, market volatility. Stock prices can fluctuate significantly, and a market downturn can negatively impact a pension fund’s assets. This can lead to funding shortfalls and potentially jeopardize the fund’s ability to meet its obligations. Are the rewards worth the risk?

Potential Rewards of Stock Investments

The potential rewards are equally significant. Stocks have historically outperformed other asset classes over the long term, providing the growth that pension funds need to meet their obligations. This growth can help ensure that retirees receive the benefits they’ve been promised. It’s a delicate balance, but one that is essential for the financial security of millions.

Frequently Asked Questions About Public Pension Investments

So, do public pensions invest in stocks? Absolutely. It’s a vital part of their strategy to secure the financial futures of countless public servants. While there are risks involved, the potential rewards are necessary to meet their long-term obligations. The world of public pension investments is complex, but understanding the role of stocks is key to grasping the overall picture. Ultimately, it’s about ensuring that those who dedicate their lives to public service can enjoy a secure retirement;