Decoding the Deal: Understanding What 0 APR Means for Your Car Loan

The Allure of 0% APR: A Closer Look

The promise of a 0% APR car loan is undeniably attractive. It suggests you can borrow money for a car without paying any interest. Sounds too good to be true? Sometimes it is, and sometimes it’s a fantastic opportunity. Let’s delve into the details to understand what what 0 APR means in the context of car financing.

Eligibility Requirements: The Fine Print

Zero percent APR offers are rarely available to everyone. Lenders typically reserve these deals for borrowers with excellent credit scores. A high credit score demonstrates a history of responsible borrowing and repayment. Expect a credit score in the “excellent” range (typically 700 or higher) to be considered. Furthermore, you might need a substantial down payment. This reduces the lender’s risk and increases your chances of approval.

Tip: Check your credit score before visiting the dealership. Knowing your creditworthiness will help you negotiate and understand your financing options.

Factors Affecting Eligibility:

- Credit Score: Aim for a score of 700 or higher.

- Down Payment: A larger down payment increases your chances.

- Loan Term: 0% APR deals often come with shorter loan terms.

- Vehicle Type: Offers may be limited to specific models or new vehicles.

Hidden Costs and Considerations

While a 0% APR loan eliminates interest charges, it doesn’t necessarily mean the car is the cheapest option. Dealers might recoup the lost interest revenue in other ways. For example, they might offer a lower trade-in value for your existing vehicle. Or, they may be less willing to negotiate the car’s price. Carefully compare the total cost of the car, including all fees and charges, with other financing options. Don’t just focus on the what 0 APR means in isolation.

Important: Always negotiate the price of the car before discussing financing options. This ensures you get the best possible deal on the vehicle itself.

Alternatives to 0% APR

If you don’t qualify for a 0% APR loan, don’t despair! There are other ways to finance your car purchase. Consider getting pre-approved for a car loan from your bank or credit union. This allows you to compare interest rates and terms. Sometimes, a slightly higher interest rate with a longer loan term might be a better option, depending on your budget and financial goals. Remember to weigh all your options carefully.

FAQ: Understanding 0% APR Car Loans

Decoding the Deal: Understanding What 0 APR Means for Your Car Loan

The promise of a 0% APR car loan is undeniably attractive. It suggests you can borrow money for a car without paying any interest. Sounds too good to be true? Sometimes it is, and sometimes it’s a fantastic opportunity. Let’s delve into the details to understand what what 0 APR means in the context of car financing.

Zero percent APR offers are rarely available to everyone. Lenders typically reserve these deals for borrowers with excellent credit scores. A high credit score demonstrates a history of responsible borrowing and repayment. Expect a credit score in the “excellent” range (typically 700 or higher) to be considered. Furthermore, you might need a substantial down payment. This reduces the lender’s risk and increases your chances of approval.

Tip: Check your credit score before visiting the dealership. Knowing your creditworthiness will help you negotiate and understand your financing options.

- Credit Score: Aim for a score of 700 or higher.

- Down Payment: A larger down payment increases your chances.

- Loan Term: 0% APR deals often come with shorter loan terms;

- Vehicle Type: Offers may be limited to specific models or new vehicles.

While a 0% APR loan eliminates interest charges, it doesn’t necessarily mean the car is the cheapest option. Dealers might recoup the lost interest revenue in other ways. For example, they might offer a lower trade-in value for your existing vehicle. Or, they may be less willing to negotiate the car’s price. Carefully compare the total cost of the car, including all fees and charges, with other financing options. Don’t just focus on the what 0 APR means in isolation.

Important: Always negotiate the price of the car before discussing financing options. This ensures you get the best possible deal on the vehicle itself.

If you don’t qualify for a 0% APR loan, don’t despair! There are other ways to finance your car purchase. Consider getting pre-approved for a car loan from your bank or credit union. This allows you to compare interest rates and terms. Sometimes, a slightly higher interest rate with a longer loan term might be a better option, depending on your budget and financial goals. Remember to weigh all your options carefully.

Are 0% APR deals available on used cars?

The Impact of Loan Term on Overall Cost

The duration of the loan, or the loan term, significantly influences the total amount paid for the vehicle, even with a 0% APR. Shorter loan terms necessitate higher monthly payments but result in faster debt repayment. Conversely, extended loan terms reduce monthly payments, potentially making them more manageable within a budget. However, extending the loan term, even at 0% APR, means you are paying off the principal balance over a longer period, delaying the point at which you own the vehicle outright. Prudent financial planning dictates a careful assessment of budgetary constraints and long-term financial goals when selecting a loan term.

Expert Insight: While a 0% APR eliminates interest, consider the opportunity cost of tying up your capital in a depreciating asset for an extended period. Could those funds be better utilized for investments or other financial objectives?

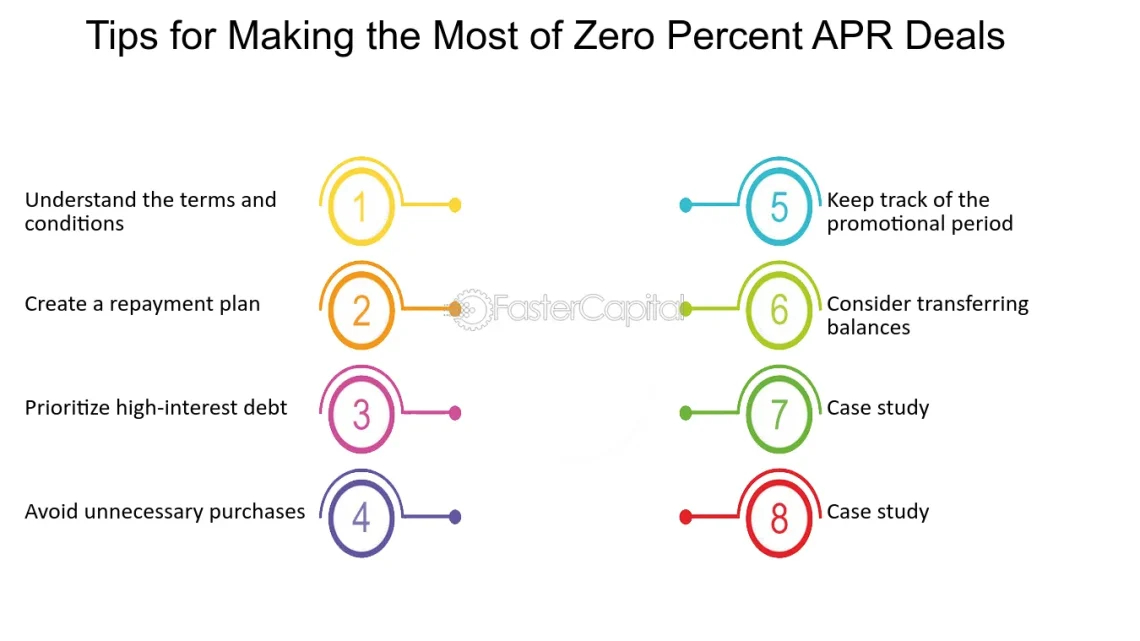

Negotiating Strategies Beyond the APR

Focusing solely on the APR can be a strategic misstep. Savvy consumers understand the importance of negotiating the vehicle’s price independently of the financing terms. Securing a lower purchase price reduces the principal loan amount, thereby decreasing the overall financial burden. Furthermore, explore potential manufacturer rebates and incentives that can further reduce the vehicle’s cost. Do not hesitate to solicit quotes from multiple dealerships to leverage competitive pricing. A well-informed and assertive negotiation strategy can yield substantial savings, irrespective of the APR.

Understanding the Dealer’s Perspective

It is crucial to recognize that dealerships are businesses operating with profit motives. While a 0% APR offer may appear altruistic, dealerships often receive incentives from manufacturers or lending institutions to promote these financing options. These incentives can offset the dealership’s perceived loss of interest revenue. Understanding this dynamic empowers consumers to engage in more informed negotiations. Question the dealership regarding the source of the 0% APR offer and inquire about any associated fees or charges. Transparency is paramount in ensuring a fair and equitable transaction.