Decoding Forex: A Practical Guide on How to Use Market Profile in Forex Trading

Understanding Market Profile Fundamentals

Market Profile is a charting technique that displays price distribution over a specific time period. It’s not just another indicator; it’s a framework for understanding market behavior. It organizes price and time data into a visual representation, revealing areas of value and potential trading opportunities. It’s a powerful tool, but understanding its core principles is crucial.

The core components of Market Profile include:

- Time Price Opportunity (TPO): Each letter represents a 30-minute period.

- Value Area (VA): The price range where 70% of the day’s volume occurred.

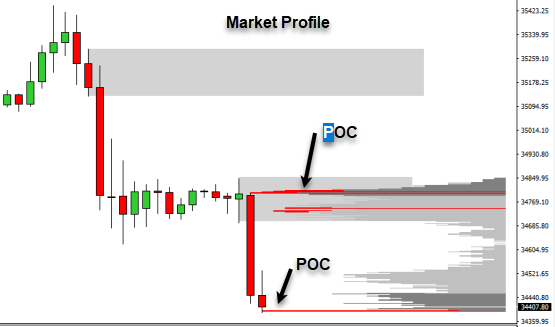

- Point of Control (POC): The price level with the highest TPO count.

These components help traders identify areas of agreement and disagreement in the market, providing insights into potential support and resistance levels.

Identifying Key Levels and Areas

Market Profile excels at highlighting key levels. These levels can act as magnets for price or as areas of strong rejection. The Value Area High (VAH) and Value Area Low (VAL) are crucial levels to watch. They represent the upper and lower boundaries of where the majority of trading activity occurred.

The Point of Control (POC) is another critical level. It represents the price level where the most trading activity took place during the profile’s timeframe. Price often revisits the POC, making it a potential area for entries or exits.

Understanding how price interacts with these levels is key to successful Market Profile trading. Observe how price reacts when it approaches these levels. Is there a bounce, a break, or consolidation?

Using Composite Profiles

Consider using composite profiles, which combine multiple days of data. This can reveal longer-term areas of value and potential support/resistance zones. This is especially useful for swing trading or position trading.

Integrating Market Profile with Forex Trading Strategies

Market Profile isn’t a standalone system. It’s best used in conjunction with other technical analysis tools and strategies. For example, you can combine Market Profile with:

- Price Action: Look for candlestick patterns near key Market Profile levels.

- Moving Averages: Use moving averages to confirm the overall trend direction.

- Fibonacci Levels: Combine Fibonacci retracements with Market Profile levels for confluence.

The key is to find a combination that suits your trading style and risk tolerance. Don’t be afraid to experiment and backtest different approaches.

Practical Examples of Market Profile in Forex

Let’s look at a hypothetical example. Imagine the EUR/USD is trading near a previous day’s POC. You also notice a bullish engulfing candlestick pattern forming at that level. This could be a strong signal to enter a long position, with a stop-loss order placed below the POC.

Another scenario: Price is approaching the Value Area High (VAH) of a composite profile. You observe bearish divergence on the RSI indicator. This could indicate that the price is likely to reverse, presenting an opportunity to enter a short position.

Remember, these are just examples. The specific signals and strategies will vary depending on the market conditions and your trading plan.

FAQ: Frequently Asked Questions About Market Profile

What timeframe is best for Market Profile in Forex?

The daily timeframe is commonly used, but you can also experiment with shorter or longer timeframes depending on your trading style.

Is Market Profile suitable for all Forex pairs?

It can be applied to most Forex pairs, but it’s generally more effective on pairs with higher liquidity and volume.

How long does it take to master Market Profile?

It takes time and practice. Expect to spend several months studying and backtesting before you become proficient.

What software is needed to use Market Profile?

Several trading platforms offer Market Profile tools, including NinjaTrader, Sierra Chart, and TradingView (with custom scripts).

Decoding Forex: A Practical Guide on How to Use Market Profile in Forex Trading

Market Profile is a charting technique that displays price distribution over a specific time period. It’s not just another indicator; it’s a framework for understanding market behavior. It organizes price and time data into a visual representation, revealing areas of value and potential trading opportunities. It’s a powerful tool, but understanding its core principles is crucial.

The core components of Market Profile include:

- Time Price Opportunity (TPO): Each letter represents a 30-minute period.

- Value Area (VA): The price range where 70% of the day’s volume occurred.

- Point of Control (POC): The price level with the highest TPO count.

These components help traders identify areas of agreement and disagreement in the market, providing insights into potential support and resistance levels.

Market Profile excels at highlighting key levels. These levels can act as magnets for price or as areas of strong rejection. The Value Area High (VAH) and Value Area Low (VAL) are crucial levels to watch. They represent the upper and lower boundaries of where the majority of trading activity occurred.

The Point of Control (POC) is another critical level; It represents the price level where the most trading activity took place during the profile’s timeframe. Price often revisits the POC, making it a potential area for entries or exits.

Understanding how price interacts with these levels is key to successful Market Profile trading. Observe how price reacts when it approaches these levels. Is there a bounce, a break, or consolidation?

Consider using composite profiles, which combine multiple days of data. This can reveal longer-term areas of value and potential support/resistance zones. This is especially useful for swing trading or position trading.

Market Profile isn’t a standalone system. It’s best used in conjunction with other technical analysis tools and strategies. For example, you can combine Market Profile with:

- Price Action: Look for candlestick patterns near key Market Profile levels.

- Moving Averages: Use moving averages to confirm the overall trend direction.

- Fibonacci Levels: Combine Fibonacci retracements with Market Profile levels for confluence.

The key is to find a combination that suits your trading style and risk tolerance. Don’t be afraid to experiment and backtest different approaches.

Let’s look at a hypothetical example. Imagine the EUR/USD is trading near a previous day’s POC. You also notice a bullish engulfing candlestick pattern forming at that level. This could be a strong signal to enter a long position, with a stop-loss order placed below the POC.

Another scenario: Price is approaching the Value Area High (VAH) of a composite profile. You observe bearish divergence on the RSI indicator. This could indicate that the price is likely to reverse, presenting an opportunity to enter a short position.

Remember, these are just examples. The specific signals and strategies will vary depending on the market conditions and your trading plan.

The daily timeframe is commonly used, but you can also experiment with shorter or longer timeframes depending on your trading style.

It can be applied to most Forex pairs, but it’s generally more effective on pairs with higher liquidity and volume.

It takes time and practice. Expect to spend several months studying and backtesting before you become proficient.

Several trading platforms offer Market Profile tools, including NinjaTrader, Sierra Chart, and TradingView (with custom scripts).

Advanced Market Profile Concepts

Beyond the foundational elements, a deeper understanding of Market Profile necessitates exploring more nuanced concepts. These include, but are not limited to, single prints, poor highs/lows, and the auction process. These elements provide further insight into market sentiment and potential future price movements.

Single Prints

Single prints represent areas where only one TPO occurred at a specific price level. They often indicate strong directional movement and can act as future support or resistance. Identifying single prints can provide clues about the strength of a trend and potential areas for retracement.

Poor Highs and Lows

A poor high or low is characterized by a lack of follow-through after reaching a new high or low. This suggests a lack of conviction from buyers or sellers, respectively, and can signal a potential reversal. These formations are particularly significant when they occur near key Market Profile levels.

The Auction Process

Market Profile views price movement as an auction process, where buyers and sellers are constantly seeking fair value. Understanding this auction process allows traders to anticipate potential price reactions and identify areas where the market is likely to find acceptance or rejection. Observing how price probes higher and lower, and whether these probes are accepted or rejected, provides valuable information about market sentiment.

Risk Management and Position Sizing with Market Profile

Effective risk management is paramount to long-term success in Forex trading. Market Profile can assist in defining risk parameters and determining appropriate position sizes. By identifying key support and resistance levels, traders can strategically place stop-loss orders to limit potential losses.

Stop-Loss Placement

A common strategy is to place stop-loss orders below the Value Area Low (VAL) for long positions or above the Value Area High (VAH) for short positions. This approach aims to protect capital while allowing the trade to develop within the expected range of market activity. The precise placement of the stop-loss should also consider the volatility of the currency pair and the trader’s risk tolerance.

Position Sizing

Position sizing should be determined based on the distance between the entry point and the stop-loss order, as well as the trader’s risk capital. A conservative approach is to risk no more than 1-2% of trading capital on any single trade. Market Profile can help refine position sizing by providing a clearer understanding of potential risk and reward scenarios.

It is crucial to remember that no trading strategy is foolproof. Consistent application of sound risk management principles is essential for preserving capital and achieving sustainable profitability.

Psychological Considerations in Market Profile Trading

Trading psychology plays a significant role in the execution of any trading strategy, including those based on Market Profile. Understanding and managing emotions such as fear and greed is crucial for making rational trading decisions. Market Profile can provide a framework for objective analysis, helping to mitigate the impact of emotional biases.

Avoiding Emotional Trading

One of the key benefits of Market Profile is its ability to provide a structured view of market activity, reducing the temptation to make impulsive decisions based on fear or greed. By focusing on the objective data presented by the profile, traders can avoid chasing price movements and stick to their pre-defined trading plan.

Maintaining Discipline

Discipline is essential for successful Market Profile trading. This includes adhering to the trading plan, consistently applying risk management rules, and avoiding the temptation to deviate from the strategy. A well-defined trading plan, based on a thorough understanding of Market Profile principles, can help maintain discipline and improve trading performance.