Debt. It’s a word that can send shivers down your spine, isn’t it? Many of us have been there, juggling multiple bills and feeling the weight of financial strain. Debt consolidation often emerges as a beacon of hope, promising a simpler path to financial freedom. But a big question lingers in the back of your mind: Does debt consolidation really help, or does it actually end up hurting your credit score in the long run? Let’s dive into the nitty-gritty and explore the truth behind debt consolidation and its impact on your credit rating.

Understanding Debt Consolidation and Your Credit Rating

Debt consolidation is essentially combining multiple debts into a single, more manageable loan or payment. This can be achieved through various methods, such as:

- Personal loans

- Balance transfer credit cards

- Home equity loans

The goal is to simplify your finances and potentially lower your interest rate. But how does this affect your credit rating? Well, it’s not a simple yes or no answer. Let’s break it down.

The Potential Downsides: How Debt Consolidation Could Impact Your Credit Rating

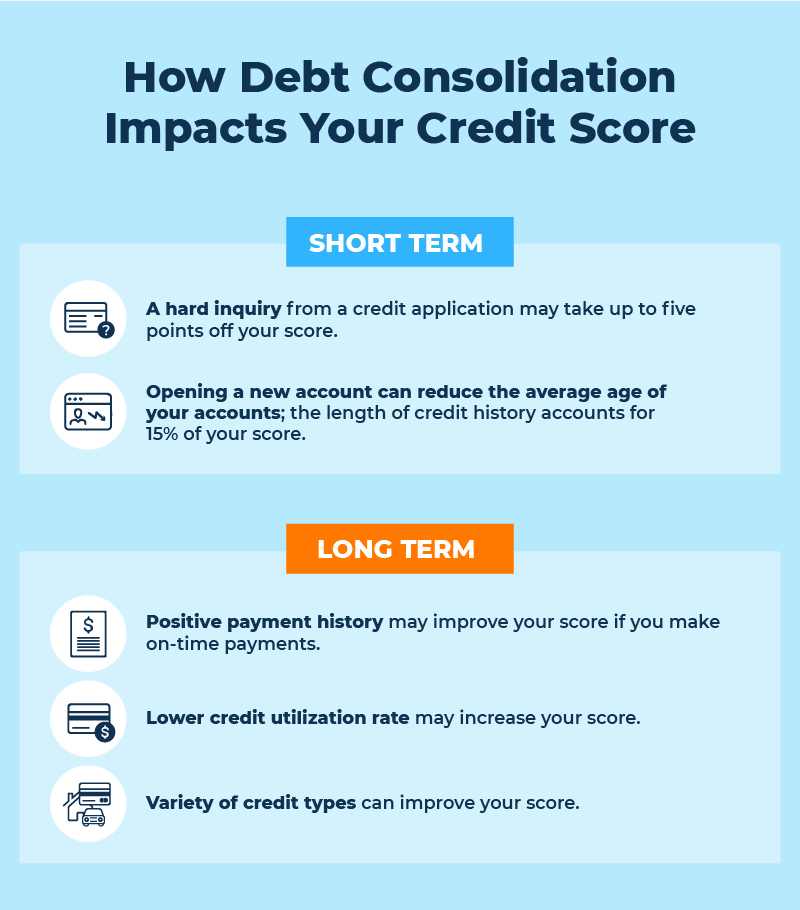

While debt consolidation can be beneficial, it’s essential to be aware of the potential negative impacts on your credit rating. Here’s what to watch out for:

Closing Old Accounts and Your Credit Rating

When you consolidate debt, you often close the old accounts. This can reduce your overall available credit, which can negatively impact your credit utilization ratio. Credit utilization is the amount of credit you’re using compared to your total available credit. Ideally, you want to keep this below 30%. Closing accounts can also shorten your credit history, another factor that influences your credit score.

Hard Inquiries and Your Credit Rating

Applying for a new loan or credit card to consolidate your debt will result in a hard inquiry on your credit report. Too many hard inquiries in a short period can lower your credit score, at least temporarily. It’s like applying for too many jobs at once – it can make you look desperate to lenders.

The Temptation to Accumulate More Debt and Your Credit Rating

This is a big one! Consolidating debt can free up credit on your old accounts. If you’re not careful, you might be tempted to start using those accounts again, leading to even more debt. This, of course, will negatively impact your credit rating.

The Potential Upsides: How Debt Consolidation Can Improve Your Credit Rating

Now, let’s look at the brighter side! Debt consolidation can actually improve your credit rating if done correctly. Here’s how:

Simplified Payments and Your Credit Rating

Having one payment to manage instead of several can make it easier to stay on top of your bills. On-time payments are crucial for building a good credit score. Missed payments, on the other hand, can significantly damage your credit.

Lower Interest Rates and Your Credit Rating

If you can secure a lower interest rate through debt consolidation, you’ll save money on interest charges. This can free up cash to pay down your debt faster, which can improve your credit utilization ratio and overall financial health.

Improved Credit Utilization and Your Credit Rating

If you’re using a balance transfer credit card, transferring high balances from other cards can lower your credit utilization ratio on those cards. Remember, keeping your credit utilization below 30% is key.

Making the Right Choice: Is Debt Consolidation Right for You and Your Credit Rating?

So, does debt consolidation ruin your credit rating? The answer is: it depends. It’s not a magic bullet, and it’s not inherently bad. It’s a tool, and like any tool, it can be used effectively or ineffectively. Consider these questions:

- Are you disciplined enough to avoid accumulating more debt after consolidating?

- Can you secure a lower interest rate than you’re currently paying?

- Will you be able to manage the new payment schedule?

If you answered “yes” to these questions, debt consolidation might be a good option for you. If not, you might want to explore other debt management strategies.

Frequently Asked Questions About Debt Consolidation and Credit Rating

Ultimately, the decision to consolidate debt is a personal one. It requires careful consideration of your financial situation and a realistic assessment of your ability to manage your debt. Don’t rush into it, do your research, and seek professional advice if needed. Remember, the goal is to improve your financial well-being, not to make things worse. With the right approach, debt consolidation can be a valuable tool in your journey to financial freedom. Good luck!