Credit cards – we all love the convenience‚ the rewards‚ and the ability to make purchases when we might be a little short on cash․ But have you ever stopped to think about what happens if you can’t pay your credit card bill? Is it just a simple matter of a ding on your credit score‚ or is there more to it? Understanding the nature of credit card debt‚ specifically whether it’s recourse or non-recourse‚ is crucial for responsible financial management․ Let’s dive in and unravel this important distinction․

Credit Cards: Understanding Recourse Debt

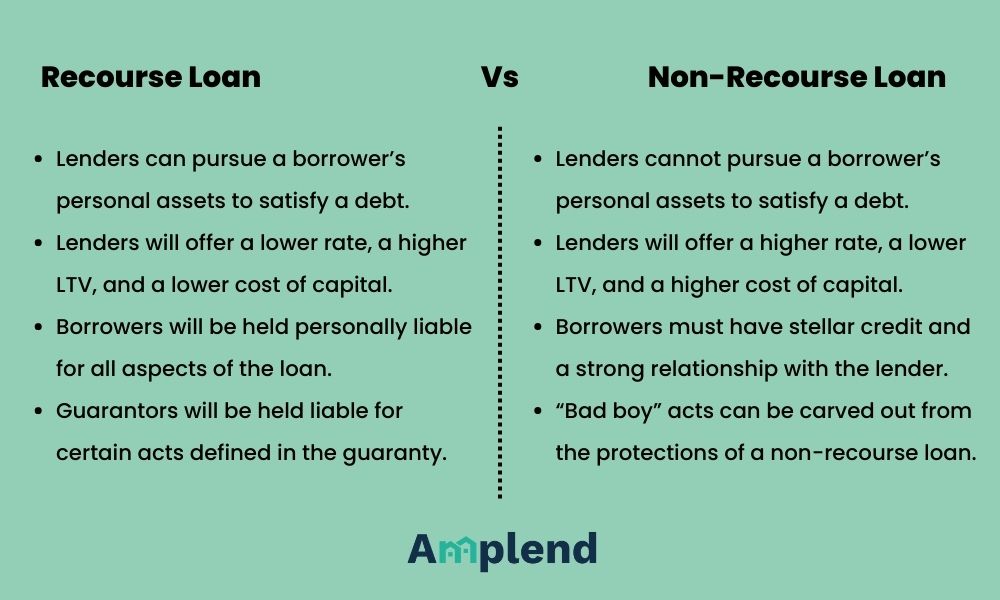

Okay‚ let’s get straight to the point: credit card debt is generally considered recourse debt․ What does that actually mean? Simply put‚ if you default on a recourse debt‚ the lender has the right to pursue you for the full amount owed‚ even if they have to take legal action․ Think of it this way: they can come after your assets to recover their losses․

What Makes Credit Card Debt Recourse?

The recourse nature of credit card debt stems from the fact that it’s an unsecured loan․ Unlike a mortgage (secured by your house) or a car loan (secured by your car)‚ there’s no specific asset backing your credit card balance․ The credit card company is essentially lending you money based on your creditworthiness and promise to repay․

Interesting Tip: Always read the fine print! Your credit card agreement will outline the lender’s rights in case of default‚ including their ability to pursue legal action and collect on the debt․

Examples of Recourse Actions for Credit Card Debt

So‚ what kind of actions can a credit card company take to recover a defaulted debt? Here are a few possibilities:

- Lawsuits: They can sue you in court to obtain a judgment for the amount owed․

- Wage Garnishment: If they win a judgment‚ they might be able to garnish your wages‚ meaning a portion of your paycheck goes directly to paying off the debt․

- Bank Levy: They could also levy your bank account‚ seizing funds to satisfy the debt․

- Liens on Property: In some cases‚ they might be able to place a lien on your property‚ making it difficult to sell or refinance until the debt is paid․

Non-Recourse Debt: A Different Ballgame

Now‚ let’s contrast that with non-recourse debt․ Imagine you take out a mortgage to buy a house․ If you default on the mortgage‚ the lender can foreclose on the house and sell it to recover their losses․ However‚ in a non-recourse loan‚ if the sale of the house doesn’t cover the full amount owed‚ the lender cannot pursue you for the remaining balance․ They’re limited to recovering the asset that secured the loan․

Why Credit Cards Aren’t Non-Recourse

Because credit cards are unsecured‚ they don’t fall into this category․ There’s no specific asset the lender can repossess to cover the debt․ This is why they have the right to pursue you personally for the full amount owed․

Important Note: While credit card debt is generally recourse‚ laws vary by state․ Some states have restrictions on wage garnishment or other collection actions‚ so it’s always a good idea to consult with a legal professional to understand your rights․

Managing Credit Card Debt Responsibly

Knowing that credit card debt is recourse should underscore the importance of managing your credit cards responsibly․ It’s not just about avoiding late fees; it’s about protecting your financial well-being․

Tips for Avoiding Credit Card Debt Problems

Here are some practical tips to help you stay on top of your credit card usage:

- Create a Budget: Track your income and expenses to ensure you’re not overspending․

- Pay Your Bills on Time: Late payments can trigger penalties and damage your credit score․

- Pay More Than the Minimum: Paying only the minimum each month can lead to a mountain of debt due to interest charges․

- Avoid Maxing Out Your Cards: Keeping your credit utilization low (the amount of credit you’re using compared to your total credit limit) can improve your credit score․

- Consider a Balance Transfer: If you’re struggling with high interest rates‚ consider transferring your balance to a card with a lower rate․

What to Do If You’re Struggling with Credit Card Debt

If you’re already facing credit card debt problems‚ don’t despair! There are options available to help you get back on track:

- Contact Your Creditors: Explain your situation and see if they’re willing to work with you on a payment plan or lower interest rate․

- Credit Counseling: Non-profit credit counseling agencies can provide guidance and help you develop a debt management plan․

- Debt Consolidation: Consider consolidating your debts into a single loan with a lower interest rate․

- Bankruptcy: As a last resort‚ bankruptcy can provide debt relief‚ but it can also have a significant impact on your credit score․

Credit Card Debt and State Laws

It’s important to remember that state laws can significantly impact how credit card debt is handled․ Some states have stricter regulations on debt collection practices‚ wage garnishment‚ and the statute of limitations for debt collection (the time period within which a creditor can sue you to collect a debt)․ Understanding the laws in your state is crucial for protecting your rights․

Researching Your State’s Laws

You can find information about your state’s debt collection laws on your state’s government website or by consulting with a legal professional․ Knowledge is power when it comes to dealing with debt!

FAQ: Credit Card Recourse Debt

Q: Can a credit card company take my house if I don’t pay?

A: Generally‚ no․ Since credit card debt is unsecured‚ they can’t directly seize your house․ However‚ they could obtain a judgment against you and then place a lien on your property‚ which would make it difficult to sell or refinance․

Q: Can they garnish my wages for credit card debt?

A: Yes‚ if they obtain a judgment against you‚ they may be able to garnish your wages‚ depending on your state’s laws․

Q: What happens if I ignore a credit card lawsuit?

A: If you ignore a lawsuit‚ the credit card company will likely win a default judgment against you‚ giving them the legal right to pursue collection actions like wage garnishment or bank levies․

Q: Is there a time limit on how long a credit card company can sue me?

A: Yes‚ there’s a statute of limitations on debt collection‚ which varies by state․ Once the statute of limitations expires‚ the credit card company can no longer sue you to collect the debt․

So‚ there you have it․ Credit card debt is generally recourse debt‚ meaning lenders can pursue various legal avenues to recover what’s owed․ It’s a sobering thought‚ isn’t it? But with responsible credit card management‚ you can avoid the pitfalls of debt and protect your financial future․ Remember to budget wisely‚ pay your bills on time‚ and seek help if you’re struggling․ Your financial well-being is worth the effort․