Credit cards. Those little pieces of plastic that promise convenience and purchasing power. But are they a blessing or a curse? We often hear about Americans and their credit card debt‚ but what about our friends across the pond? Do Europeans also find themselves swimming in a sea of debt fueled by these tempting cards? Let’s dive into the world of European finance and explore the reality of credit card debt in Europe. It might surprise you!

Understanding Credit Card Debt Levels in Europe

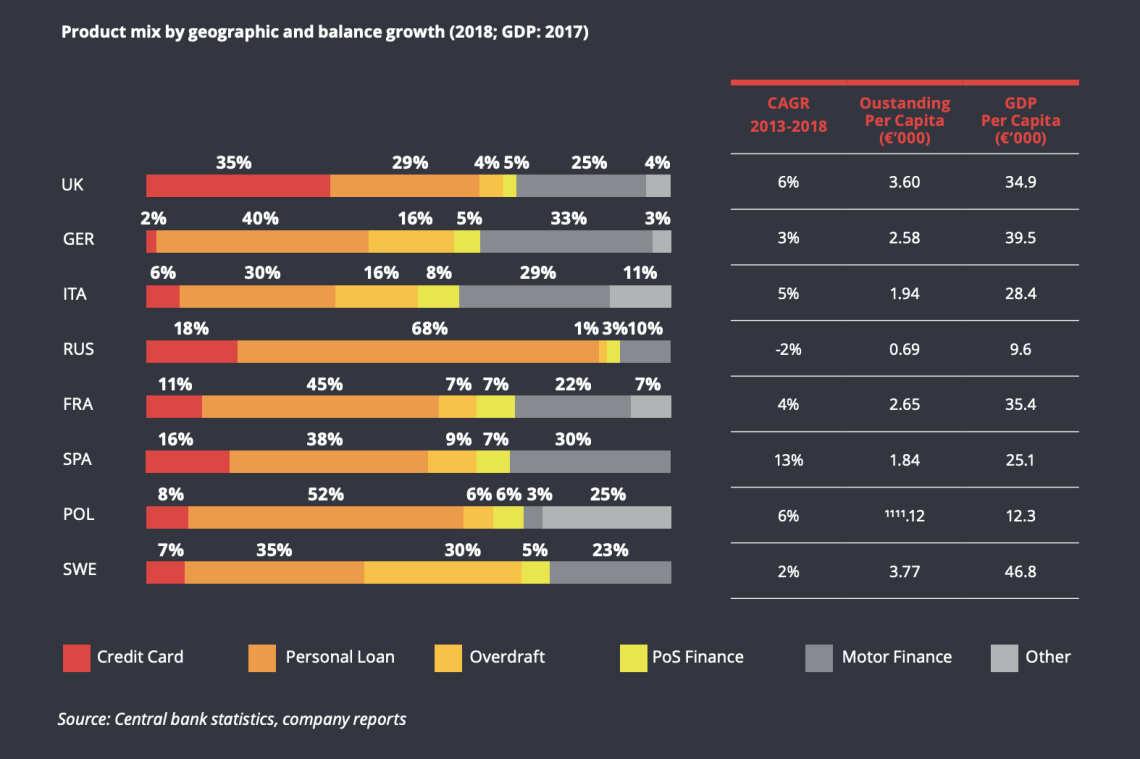

So‚ how does Europe stack up when it comes to credit card debt? It’s not as simple as a yes or no answer. Different countries have different financial cultures and regulations‚ leading to varying levels of credit card usage and debt accumulation. Some countries are much more reliant on credit cards than others. Let’s take a closer look.

- Scandinavia: Generally lower credit card debt due to a preference for debit cards and strong financial literacy.

- Southern Europe: Countries like Italy and Spain tend to have higher credit card usage‚ though still generally lower than the US.

- UK: The UK often sees higher credit card balances compared to other European nations.

Factors Influencing European Credit Card Debt

What drives credit card debt in Europe? Several factors come into play. It’s not just about overspending; it’s a complex interplay of economic conditions‚ cultural norms‚ and access to credit.

Economic Conditions and Credit Card Debt

A country’s economic health plays a significant role. During times of economic hardship‚ people may rely more on credit cards to cover essential expenses. Conversely‚ in prosperous times‚ people might use credit cards more for discretionary spending.

Cultural Attitudes Towards Credit Card Debt

Culture matters! Some cultures are more debt-averse than others. In some European countries‚ there’s a greater emphasis on saving and avoiding debt‚ while in others‚ credit is seen as a more acceptable tool for managing finances.

Did you know? Many European countries have stricter regulations on credit card interest rates and fees compared to the United States. This can help to keep debt levels more manageable.

Comparing European Credit Card Debt to the United States

Let’s face it‚ the US is often the benchmark for credit card debt. But how do Europeans fare in comparison? Generally‚ credit card debt levels are lower in Europe than in the United States. Why is that?

- Stricter Regulations: As mentioned earlier‚ regulations on interest rates and fees are often tighter in Europe.

- Different Financial Habits: Europeans often rely more on debit cards and other forms of payment.

- Social Safety Nets: Stronger social safety nets in some European countries can provide a buffer during financial difficulties.

However‚ it’s important to remember that averages can be misleading; There are certainly individuals in Europe who struggle with significant credit card debt.

Managing Credit Card Debt Effectively in Europe

Whether you’re in Europe or elsewhere‚ managing credit card debt is crucial. What strategies can Europeans use to keep their debt under control?

Budgeting and Tracking Expenses to Avoid Credit Card Debt

Creating a budget and tracking your spending is a fundamental step. Knowing where your money is going can help you identify areas where you can cut back and avoid relying on credit cards.

Strategies for Paying Down Existing Credit Card Debt

If you already have credit card debt‚ there are several strategies you can use to pay it down. Consider methods like the snowball method (paying off the smallest balance first) or the avalanche method (paying off the highest interest rate first).

Tip: Look into balance transfer options. Some European banks offer balance transfer cards with low or zero interest rates for a limited time; This can be a great way to save money on interest while you pay down your debt.

FAQ: European Credit Card Debt

So‚ do Europeans struggle with credit card debt? The answer is nuanced. While overall debt levels are generally lower than in the United States‚ it’s still a reality for many. Understanding the factors that contribute to debt and implementing effective management strategies are key to maintaining financial well-being‚ no matter where you live. Remember‚ responsible credit card use is about control‚ not being controlled. Take charge of your finances and make informed decisions. Your future self will thank you!