Finding the perfect apartment can feel like winning the lottery! You’ve got your eye on that sunny corner unit‚ you can already picture yourself decorating‚ and then… the application process․ Suddenly‚ you’re facing a barrage of questions about your finances‚ and a nagging worry creeps in․ Could that credit card debt you’re working to pay down actually prevent you from getting the keys? It’s a valid concern‚ and understanding how landlords view debt is crucial to navigating the rental market successfully․ Let’s dive into how credit card debt can impact your rental application and what you can do about it․

Credit Card Debt and Your Rental Application: What Landlords Look For

Landlords want reliable tenants․ They want to be confident that you’ll pay rent on time‚ every time․ So‚ how does credit card debt factor into their decision-making process? It’s not always a simple “yes” or “no․”

Credit Score: The Key Indicator

Your credit score is a numerical representation of your creditworthiness․ It’s based on your payment history‚ the amount of debt you owe‚ the length of your credit history‚ and other factors․ Landlords often use your credit score as a quick way to assess your financial responsibility․ A lower credit score‚ often resulting from high credit card debt‚ can raise red flags․

Debt-to-Income Ratio: Can You Afford the Rent?

Landlords also consider your debt-to-income ratio (DTI)․ This is the percentage of your gross monthly income that goes towards paying your debts‚ including credit card bills‚ student loans‚ and car payments․ A high DTI suggests that you might struggle to afford rent‚ especially if you’re already stretched thin financially․

Rental History: A Predictor of Future Behavior

A solid rental history‚ with on-time payments and no evictions‚ can often outweigh some concerns about credit card debt․ Landlords like to see a track record of responsible renting․

How Much Credit Card Debt is Too Much When Renting?

There’s no magic number‚ but generally‚ a large amount of outstanding credit card debt‚ especially if it’s close to your credit limit‚ can be problematic․ Landlords might worry that you’re overextended and at risk of missing rent payments․

Factors That Influence the Landlord’s Decision

- The amount of debt: A small balance isn’t as concerning as a large one․

- Your credit utilization ratio: This is the amount of credit you’re using compared to your total available credit․ A high utilization ratio (over 30%) can negatively impact your credit score․

- Your payment history: Have you been making on-time payments? Late payments are a major red flag․

- The overall rental market: In a competitive market‚ landlords might be more selective․

What Can You Do to Mitigate the Impact of Credit Card Debt?

Don’t despair! There are steps you can take to improve your chances of getting approved‚ even with credit card debt․

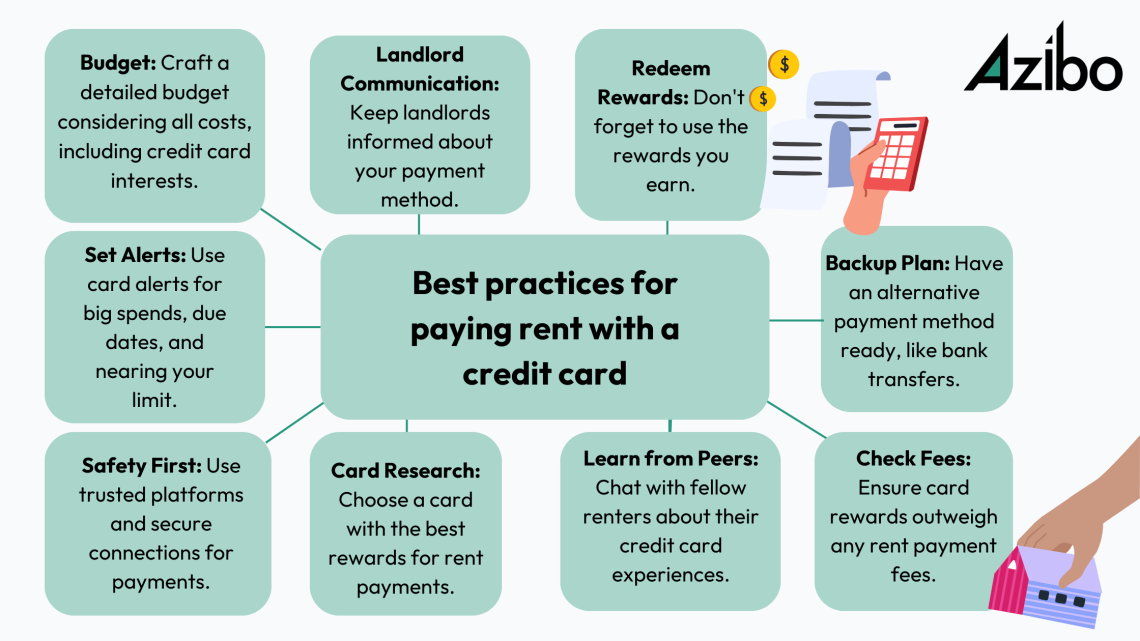

Strategies to Overcome Credit Card Debt Concerns in Your Rental Application

Improve Your Credit Score

This is a long-term strategy‚ but it’s the most effective․ Focus on paying down your credit card balances‚ making on-time payments‚ and avoiding new debt․

Lower Your Credit Utilization Ratio

Aim to use less than 30% of your available credit on each card․ Paying down your balances before the billing cycle closes can help with this․

Provide Explanations and Documentation

Be upfront with the landlord about your credit card debt․ Explain any extenuating circumstances‚ such as job loss or medical expenses․ Provide documentation to support your claims․

Offer a Larger Security Deposit

Offering a larger security deposit can demonstrate your commitment and provide the landlord with extra security․

Get a Co-Signer or Guarantor

If you have a friend or family member with good credit and a stable income‚ they might be willing to co-sign your lease․ This provides the landlord with additional assurance․

Highlight Your Strengths

- Stable employment history

- Good rental history

- Sufficient income

- Positive references from previous landlords

Alternative Options if Credit Card Debt is a Major Obstacle

Look for Landlords with Less Stringent Requirements

Some landlords are more lenient than others․ Look for smaller landlords or those who are willing to work with tenants who have less-than-perfect credit․

Consider Renting with a Roommate

Sharing the rent and utilities can make it easier to afford housing‚ even with credit card debt․ Plus‚ having a roommate can provide a sense of security and companionship․

Explore Subletting Options

Subletting can be a short-term solution while you work on improving your credit score and paying down your debt․

Focus on Budgeting and Saving

Creating a budget and sticking to it can help you manage your finances and demonstrate to landlords that you’re serious about your financial responsibility․

Frequently Asked Questions About Credit Card Debt and Renting

Ultimately‚ renting with credit card debt requires a strategic approach․ By understanding how landlords assess risk‚ taking steps to improve your financial situation‚ and presenting yourself as a responsible tenant‚ you can significantly increase your chances of finding the perfect place to call home․ Don’t let debt define your possibilities; show them you’re ready to be a great tenant․ Remember‚ persistence and a positive attitude can go a long way; Good luck with your apartment search!