Buying a car can be exciting, but figuring out how to pay for it? That’s often the less thrilling part․ With so many financing options out there, it’s easy to get lost in the details․ You’ve probably heard of Affirm, known for its “buy now, pay later” approach for online purchases․ But can you use Affirm to finance a car? Let’s dive in and explore whether Affirm offers car loans and what alternatives you might consider․

Does Affirm Directly Provide Car Loans?

The short answer is: no, Affirm doesn’t directly offer traditional car loans․ Affirm primarily focuses on point-of-sale financing for smaller purchases, allowing you to split payments over time at various online retailers․ Think of it as a way to finance that new couch or those stylish shoes, not typically a vehicle․

However, the financial landscape is always evolving․ So, while Affirm doesn’t directly offer car loans today, it’s worth understanding what they do offer and how it might relate to your car-buying journey․

Understanding Affirm’s Financing Model

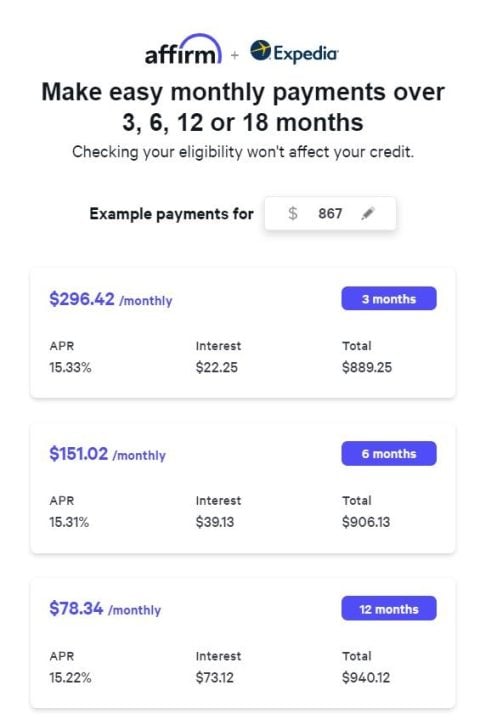

Affirm partners with various retailers to offer financing at the point of sale․ When you make a purchase, you can choose Affirm as a payment option and potentially split the cost into manageable monthly installments․ This is great for smaller purchases, but how does it compare to traditional car loans?

Here’s a quick breakdown:

- Focus: Primarily smaller purchases at partnered retailers․

- Loan Amounts: Typically lower than car loan amounts․

- Repayment Terms: Shorter repayment periods, often a few months to a few years․

- Interest Rates: Can vary depending on your creditworthiness and the retailer;

So, while you can’t get a direct “Affirm car loan,” let’s consider how you might indirectly use Affirm in the context of car ownership․

Indirectly Using Affirm for Car-Related Expenses

While Affirm won’t finance the car itself, think about the accessories! Need new tires? A killer sound system? Maybe some custom floor mats? If the retailer accepts Affirm, you could use it to finance these smaller, car-related purchases․ It’s not the main course, but it can be a helpful side dish!

Consider these scenarios:

- Car Repairs: Some auto repair shops might partner with Affirm to offer financing for larger repair bills․

- Accessories: Purchase new car accessories online from retailers that accept Affirm․

- Down Payment Savings: While not directly Affirm, using Affirm for smaller purchases could free up cash to save for a larger car down payment․

Exploring Alternatives to Affirm Car Loans

Since Affirm isn’t a direct route to car financing, what are your other options? Don’t worry, you have plenty!

- Traditional Auto Loans: Banks, credit unions, and dealerships offer traditional car loans․

- Online Lenders: Several online lenders specialize in auto financing․

- Personal Loans: A personal loan could be used to purchase a car, but interest rates might be higher․

Finding the Best Car Loan for Your Needs

Securing the best car loan involves a bit of research and preparation․ Don’t just jump at the first offer you see! Take the time to compare rates, terms, and loan amounts from different lenders․

Here’s what to keep in mind:

- Credit Score: A higher credit score typically means lower interest rates․

- Down Payment: A larger down payment can reduce your loan amount and monthly payments․

- Loan Term: Shorter loan terms mean higher monthly payments but less interest paid over time․

- APR: Pay close attention to the Annual Percentage Rate (APR), which includes interest and fees․

Comparing Car Loan Options

Let’s say you’re looking at two different loan offers․ One has a lower interest rate but a longer term․ The other has a higher interest rate but a shorter term․ Which one is better? It depends on your priorities! Do you want lower monthly payments or to pay less interest overall? Think carefully about what matters most to you․

Frequently Asked Questions About Affirm and Car Loans

So, while Affirm isn’t your ticket to a full-fledged car loan, understanding its limitations and exploring other financing avenues is key․ Remember to shop around, compare offers, and choose the option that best fits your financial situation․ Buying a car is a big decision, and making informed choices will set you up for success․ Don’t rush the process, and always read the fine print․ Happy car hunting! Consider your budget and long-term financial goals before committing to any loan․