Buffett’s Portfolio Unveiled: Decoding Which Companies Did Warren Buffett Invest In

A Glimpse into the Oracle’s Holdings

Warren Buffett, the chairman and CEO of Berkshire Hathaway, is renowned for his value investing philosophy․ His investment decisions are closely watched by investors worldwide․ Understanding which companies did Warren Buffett invest in provides valuable insights into his investment strategy and market outlook․ This article delves into some of his key holdings and the rationale behind them․

Key Sectors and Companies

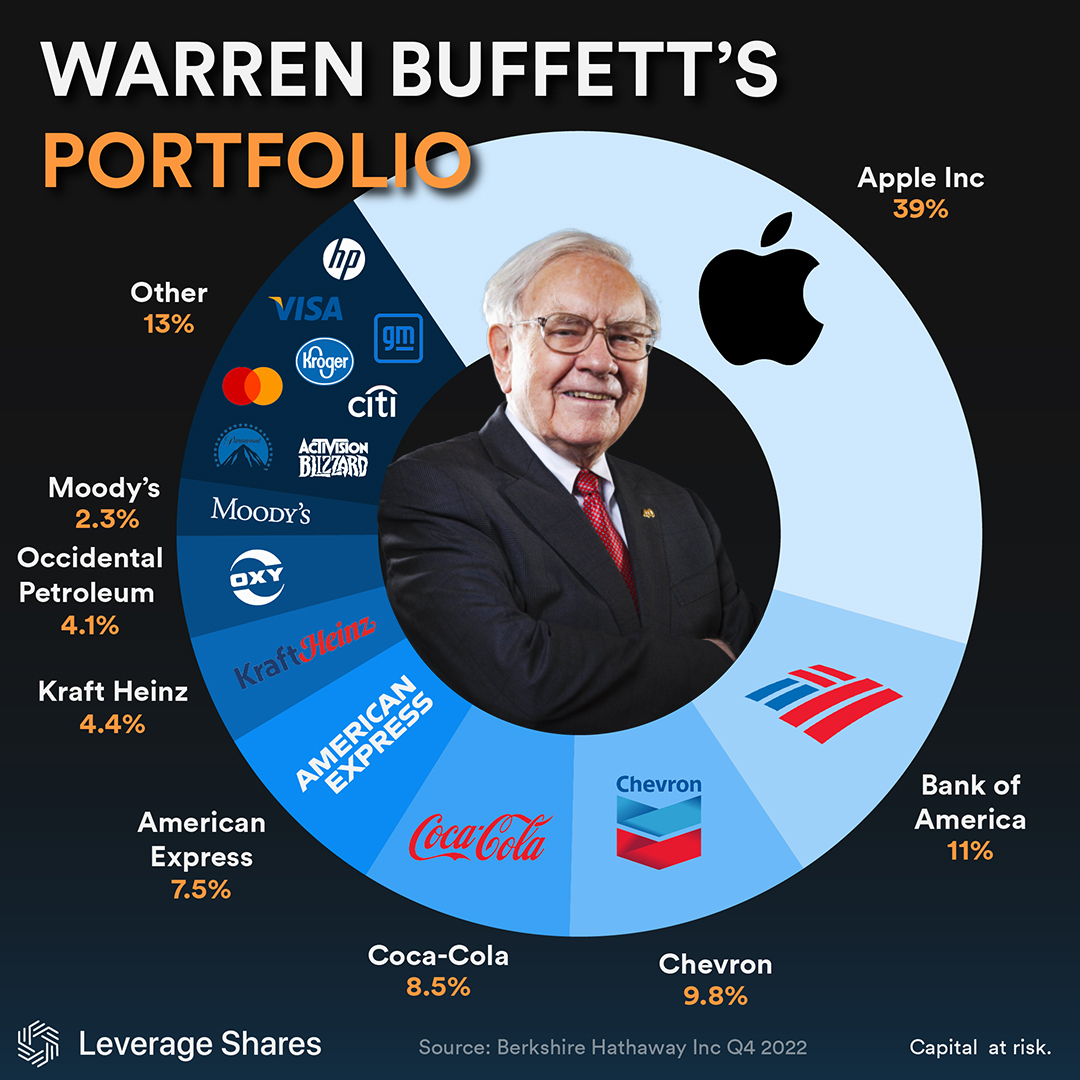

Buffett’s portfolio is diversified across various sectors, but he has a clear preference for certain industries․ He favors companies with strong brands, consistent earnings, and capable management teams․ Let’s explore some of the prominent sectors and companies that have consistently appeared in Berkshire Hathaway’s portfolio․

- Financials: Bank of America, American Express

- Consumer Staples: Coca-Cola, Kraft Heinz

- Technology: Apple

- Energy: Chevron, Occidental Petroleum

These are just a few examples, and the composition of the portfolio can change over time based on Buffett’s assessment of market conditions and individual company prospects․

The Rationale Behind the Investments

Buffett’s investment decisions are driven by a long-term perspective and a focus on intrinsic value․ He seeks to invest in companies that are undervalued by the market and have the potential to generate consistent returns over time․ He often holds these investments for many years, sometimes even decades․

He avoids companies with complex business models or those operating in rapidly changing industries that he doesn’t fully understand․ This approach allows him to make informed decisions and minimize risk․

Frequently Asked Questions

Does Warren Buffett invest in dividend-paying stocks?

Yes, many of the companies in Berkshire Hathaway’s portfolio pay dividends․ Buffett appreciates the steady income stream that dividends provide, especially during periods of market volatility․

How often does Buffett change his portfolio?

Buffett is known for his patient approach to investing․ He typically makes changes to his portfolio infrequently, preferring to hold onto investments for the long term․ However, he will adjust his holdings if he believes a company’s fundamentals have deteriorated or if he identifies a more attractive investment opportunity․

Where can I find the most up-to-date information on Berkshire Hathaway’s holdings?

Berkshire Hathaway is required to file a 13F report with the Securities and Exchange Commission (SEC) on a quarterly basis․ This report discloses the company’s equity holdings․ You can find these reports on the SEC’s website or through various financial news outlets․

Analyzing Buffett’s Investment Criteria

A rigorous framework underpins Mr․ Buffett’s investment selections․ Beyond mere financial metrics, qualitative factors assume paramount importance․ A discernible competitive advantage, often referred to as a “moat,” is a prerequisite․ This moat may manifest as brand recognition, proprietary technology, or a cost advantage that shields the company from competitive pressures․ Furthermore, the integrity and competence of the management team are meticulously evaluated․ Mr․ Buffett seeks leaders who demonstrate a commitment to shareholder value and possess a proven track record of sound capital allocation․

The Importance of Intrinsic Value

Central to Mr․ Buffett’s investment philosophy is the concept of intrinsic value․ This represents the true economic worth of a company, independent of its current market price․ Determining intrinsic value requires a thorough analysis of a company’s financial statements, its competitive landscape, and its future growth prospects․ Mr․ Buffett employs discounted cash flow analysis and other valuation techniques to estimate intrinsic value․ He then seeks to acquire shares of companies trading at a significant discount to their intrinsic value, thereby providing a margin of safety․

Notable Investment Successes and Lessons Learned

Berkshire Hathaway’s investment history is replete with examples of remarkable successes․ The long-term investments in companies such as Coca-Cola and American Express have generated substantial returns for shareholders․ These investments exemplify Mr․ Buffett’s ability to identify and hold onto high-quality businesses for extended periods․ However, not all investments have been successful․ Mr․ Buffett has acknowledged past mistakes, such as the investment in Dexter Shoe, and has emphasized the importance of learning from these experiences․ These lessons underscore the inherent risks associated with investing and the need for continuous self-assessment․

The key to successful investing is not to outperform the market, but to avoid significant losses․

- Coca-Cola: A classic example of a long-term investment in a brand with enduring appeal․

- American Express: Demonstrated the power of brand and customer loyalty․

- Apple: A more recent investment showcasing adaptability to evolving technological landscapes․

The Future of Buffett’s Investments

As Mr․ Buffett approaches his twilight years, succession planning and the future direction of Berkshire Hathaway are subjects of considerable interest․ While the specific details of the succession plan remain confidential, it is widely anticipated that the company will continue to adhere to Mr․ Buffett’s value investing principles․ The designated successors, Greg Abel and Ajit Jain, are highly regarded within the investment community and are expected to maintain Berkshire Hathaway’s focus on long-term value creation․ The company’s substantial cash reserves provide ample flexibility to pursue future investment opportunities and navigate potential economic downturns․ The legacy of Warren Buffett’s investment acumen is poised to endure for generations to come․